NAGPUR: The common belief that only the wealthy are behind in paying property tax is wrong. The Nagpur Municipal Corporation (NMC) data shows most defaulters owe less than 10,000 in property tax.

A staggering 3.3 lakh are in this group, adding up to 59.38 crore in unpaid taxes. In contrast, 136 owners with over 5 lakh in tax dues owe NMC a total of 58.53 crore.

A close look at the tax defaulters released by NMC revealed that out of 7.05 lakh property owners in Nagpur, almost half or 3.4 lakh have not paid their property tax in the last financial year (2023-24). The total dues from them amount to 140.93 crore.

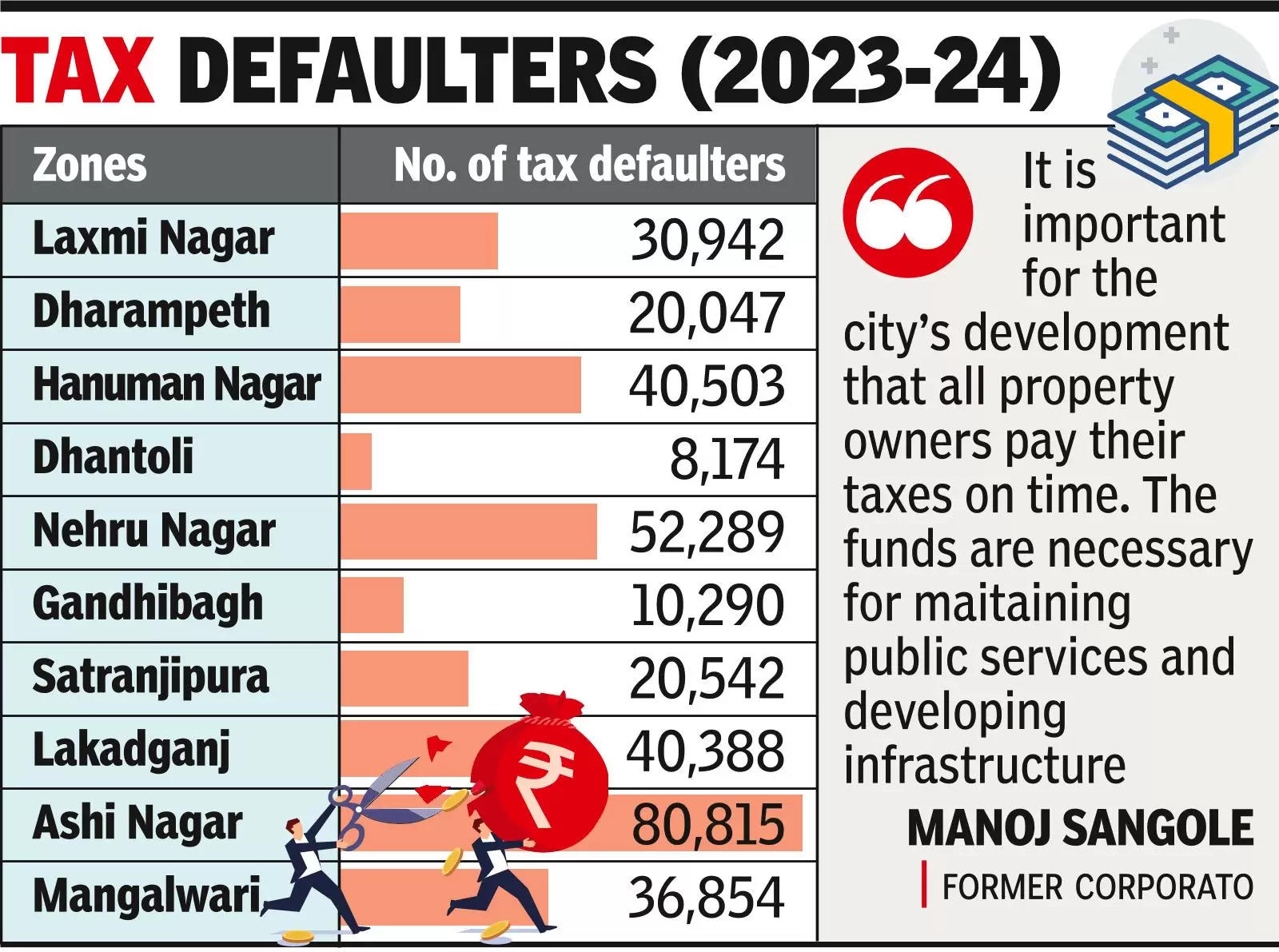

The data further revealed residents from Ashi Nagar zone top the list of defaulters among the 10 zones of NMC. A total of 80,815 owners here are yet to clear their dues. Nehru Nagar zone comes next, with 52,289 property owners not paying tax for the financial year 2023-2024. Hanuman Nagar has 40,503 defaulters, while Lakadganj is close behind with 40,388.

In Mangalwari, 36,854 owners have not paid their tax. Laxmi Nagar has 30,942 defaulters, and Satranjipura has 20,542. Dharampeth zone reports 20,047 property owners who haven’t paid their tax. Gandhibagh has a lower number of defaulters at 10,290, and Dhantoli has the least, with 8,174 owners not clearing their dues.

By March 31, 2023, the total property tax arrears for NMC since last three to four decades exceeded 731 crore.

Regular tax payments are crucial for NMC to deliver services effectively. This is a significant amount and shows that many people are behind on their payments. The corporation may need to take steps to collect this large sum of money, said former corporator Manoj Sangole.

“It is important for the city’s development that all property owners pay their taxes on time. The funds are necessary for maitaining public services and developing infrastructure,” he pointed out.

Endorsing Sangole, an NMC finance department official highlighted the importance of these collections. He mentioned ongoing projects funded by the government, where NMC must cover half the costs. Full tax recovery would eliminate the need for borrowing, ensuring better financial health for NMC.

To recover the arrears, NMC had launched an amnesty scheme early this year, which evoked poor response. The scheme fetched only 69.43 crore between January 1, 2024 and March 31, 2024.

Meanwhile, to improve tax collection, NMC has already announced several schemes like 15% rebate in property tax to encourage timely payments if property owners pay their civic body tax before June-end.