The Adani Group has emerged as frontrunner in the race to acquire the promoter’s 46.64% stake in ITD Cementation India to bolster its in-house civil engineering capabilities, said people aware of the matter. At current market value, a successful deal would be pegged at 5,888.57 crore ($700 million), inclusive of a fully subscribed open offer that will follow a promoter stake purchase.

The infrastructure conglomerate led by Gautam Adani is ramping up its expansive portfolio spanning airports, highways, ports, power plants and real estate projects. Both sides came to an agreement earlier this week and a formal announcement is due soon, said one of the persons.

However, this could not be independently verified.

ITD Cementation India is an engineering, procurement and construction (EPC) company with roots in the UK dating back to before India’s independence, having changed hands several times since.

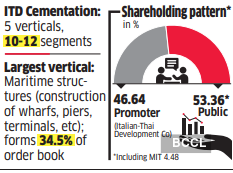

ITD’s promoter Italian-Thai Development Public Co held a 46.64% stake at the end of the June quarter. The company informed the stock exchanges in July that “the promoter shareholders of ITD Cementation India are exploring a potential, possible divestment of their investments in the company”. The sale process was at a preliminary stage and no definitive agreement had been reached yet, it had said.

The Adani Group, Italian-Thai Development and ITD Cementation didn’t respond to queries.

The Adani Group is believed to have trumped rival bids from Abu Dhabi’s leading dredging company and the RPG Group’s KEC International.

ITD Cementation has a market value of Rs 8,107 crore. A promoter stake sale will trigger an open offer for an additional 26% stake. Incidentally, the Massachusetts Institute of Technology (MIT) is one of the top shareholders with a 4.5% stake at the end of June. However, a deal could be below the market value, given the rise in the stock price, analysts said. In the year to July, the stock more than tripled in value. In the past year, it’s risen 114%.

ITD Cementation India is a leader in maritime structures and engineering works, such as the Delhi and Kolkata metro projects. It’s also worked on ports in Tuticorin, Haldia, Mundra and Vizhinjam as well as the Jawaharlal Nehru Port Trust and is seen as a strategic fit for Adani. Maritime structures—wharfs, piers, container terminals, berths, oil jetties—account for 34.5% of the order book, making this ITD’s biggest vertical. It already has a business relationship with Adani in hydel power and marine as well as the 594 km Ganga Expressway toll road project.

The July’s announcement about the stake sale had come as a surprise since it had just won a marine contract worth Rs 1,082 crore for the Dahej LNG Terminal. Prior to that, in February, the company’s management had said it was expecting orders of Rs 8,000-10,000 crore in FY25.

Analysts said the surge in the stock may have persuaded the management to cash out by taking advantage of the market momentum.

If completed, this will be the 11th acquisition so far this year by the Ahmedabad-based Adani Group and is likely to be routed through flagship Adani Enterprises Ltd (AEL), said the people cited.

On Thursday, AEL closed at Rs 2,942.35 on the BSE, nearly unchanged, at a market value of Rs 3.35 lakh crore.

The development comes as AEL is partnering Israel’s Tower Semiconductors on a $10 billion semiconductor fabrication plant in Maharashtra, as posted by state deputy chief minister Devendra Fadnavis on X two weeks ago.

With a number of projects launched or about to get underway as part of the government’s infrastructure push, the EPC business is set for a sustained upswing.

ITD Cementation “is also diversified into pumped storage and specialised hydro projects which are now in vogue for renewable players like Adani Green and their pursuit of offering 24×7 green power solutions to utilities and corporate clients”, said one of the persons cited. “They are expecting Rs 5,000-6,000 crore worth of tenders coming their way from new hydro and pumped storage projects this fiscal.” Also on the anvil are large-scale solar projects.

The company’s management has said a promoter stake sale is unlikely to affect its ongoing operations.

“We are not dependent on any funding from the parent or there are no guarantees that the parent has provided for us,” CFO Prasad Patwardhan told analysts in August during an earnings call. “So, in terms of operations, we don’t expect, as of now, any impact on our day-to-day operations.”

On the same call, managing director Jayanta Basu said, “Whoever comes as a parent, they’ll definitely have interest to grow this company. Otherwise, why will they buy it?”

The company secured orders worth over Rs 1,053 crore in the June quarter. Its total multi-year orderbook visibility is at Rs 18,536 crore, of which government contracts are almost half (48%), while private sector projects account for 35% with the remaining 17% from public sector units (PSUs). Beyond a national footprint of 13 states and a Union territory, the company is also working on projects in Sri Lanka and Bangladesh.

Other than maritime, ITD Cementation also specialises in urban infrastructure and urban mass rapid transportation networks such as metro projects, highways, bridges, flyovers, industrial structures, buildings, hydel power, dams, irrigation projects, specialised engineering works like foundation, tunnelling, water and waste.

In 2004, the Italian-Thai Development Public Co entered into a share purchase agreement with the Cementation Co of the UK and Skanska AB. After this, the company changed its name to ITD Cementation and obtained a fresh certificate of incorporation on May 26, 2005. This was the third time the company was changing hands.