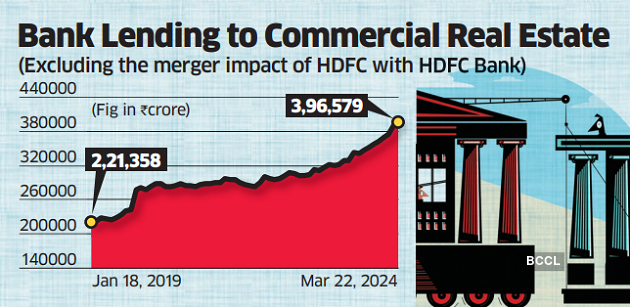

Bank loans to commercial real estate which also includes residential construction, last fiscal year nearly tripled at 23 percent, excluding the impact of the merger of HDFC with HDFC Bank. Outstanding loans amounted to Rs 3.97 lakh crore.

If one includes the merger impact, the loan growth works out 38.9 percent and the outstanding loans as of March 31 works out to Rs 4.48 lakh crore.

The real estate sector is growing across segments said property analysts. Top seven property markets in the country registered total sales of 74,486 apartments during the quarter. This marks the second consecutive quarter of sales exceeding 74,000 units after December quarter’s record-breaking 75,591 apartments, showed data from JLL India.

“ There is a demand for bank loans across segments including residential, infra-centric projects and even commercial projects like corporate offices” said Bhavik Hathi is a Managing Director with Alvarez & Marsal’s Global Transaction Advisory Group. “ Banks are being risk averse They are cautious in lending to residential projects.”

“ This positive trend is supported by the transparency and regulatory clarity brought in by RERA, which has not only infused confidence among the stakeholders but also streamlined the approval processes, making it easier for developers to deliver projects on time” said .Prashant Sharma, President, NAREDCO Maharashtra. “ The commitment of reputed developers to adhere to timelines and maintain quality standards has played a crucial role in attracting more institutional funding into the sector. It is imperative that we continue to foster this confidence through enhanced transparency, robust project execution, and strategic regulatory support”.

Banks have been proactive with their prudent risk assessment especially in the residential projects, aligning with our long-term vision for a more balanced and resilient real estate sector, according to a real estate analyst.

Ratings firm Crisil said that Continuing premiumisation, favourable affordability along with rising per capita incomes should help large, listed residential developers2 build 10-12% volume growth this fiscal after an estimated growth of ~14% on a high base in fiscal 2024.

Ratings firm India-Ratings expects that assumes new supply and absorption rates will grow at 5%-6% year-on-year (y-o-y) and 7%-8% y-o-y, respectively, in FY’25. The absorption demand is likely to come from various sectors, especially flex operators, BFSI and engineering, seeking Grade A office spaces.

Ind-Ra expects rental growth to be modest in the band of 3%-5% in FY25, due to the high supply over FY22-FY24 leading to sticky vacancies. Ind-Ra however believes India will continue to benefit from the structural advantages made available by its skilled talent pool and cost-effective office spaces.