American multinational investment company counted amongst the world’s largest asset management firms BlackRock Inc. has picked up over 42,700 sq ft office space in a premium commercial tower in central Mumbai’s plush Worli locality through a long-term lease of five years.

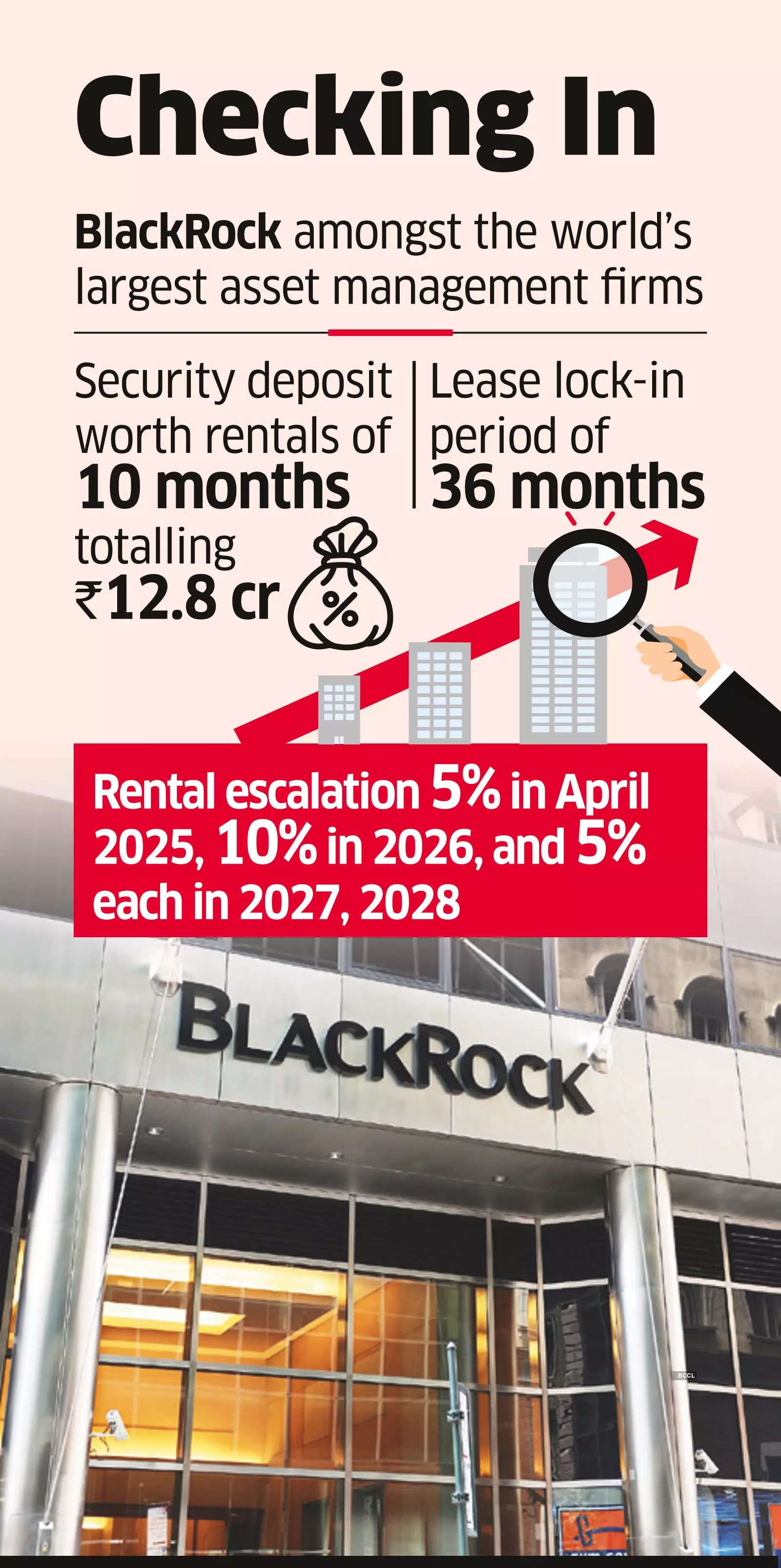

The financial institution’s India arm Blackrock Services India will be paying rental of Rs 325 per sq ft a month in the first year of the lease. The agreement includes a clause to escalate rentals by 5% in April 2025, by 10% a year after that and 5% each in 2027 and 2028.

The New York-headquartered company has leased the space on the 4th floor of the commercial tower Altimus directly from the project’s developer K Raheja Corp.

The lease starts from this month and has a lock-in period of 36 months, showed documents accessed through real estate data analytics firm Propstack. The company has paid security deposit worth rentals of 10 months totaling Rs 12.8 crore at the time of the lease agreement registration that took place in July.

ET’s query to BlackRock and K Raheja Corp remained unanswered until the time of going to press.

New infrastructure connectivity in and around Worli is driving office space deals, attracting businesses seeking enhanced accessibility and modern facilities. For instance, the completion of the Mumbai Trans-Harbour Link (MTHL) and upcoming metro network is making the area more appealing to companies including multinationals looking to open offices in prime locations with better amenities.

BlackRock has a significant presence in India aiming to tap into the country’s rapidly growing financial markets. Established in India in 2008, BlackRock is engaged in investment solutions, including mutual funds, exchange-traded funds (ETFs), and portfolio management services, catering to both institutional and retail clients. It has offices in Mumbai, Gurgaon, and Bengaluru.

Despite global economic sluggishness, the Indian office sector has experienced sustained growth in demand, reflecting strong market fundamentals and resilience against global challenges.

According to recent data, the office market surged to its best-ever first half with gross leasing of 33.5 million sq ft in, up 29% from a year ago surpassing the previous first half record performance of 30.71 million sq ft seen in 2019.

The remarkable growth in office leasing underscores the confidence in India’s commercial real estate market and its ability to attract significant investments despite broader economic uncertainties. This trend is expected to continue, driven by robust demand from various sectors and favorable market conditions.