MUMBAI: Creditors to Gayatri Projects (GPL), promoted by former Rajya Sabha MP T Subbarami Reddy, have voted to initiate liquidation proceedings against the company after rejecting the only bid from private equity fund Mark AB Capital Investment LLC, people familiar with the matter said.

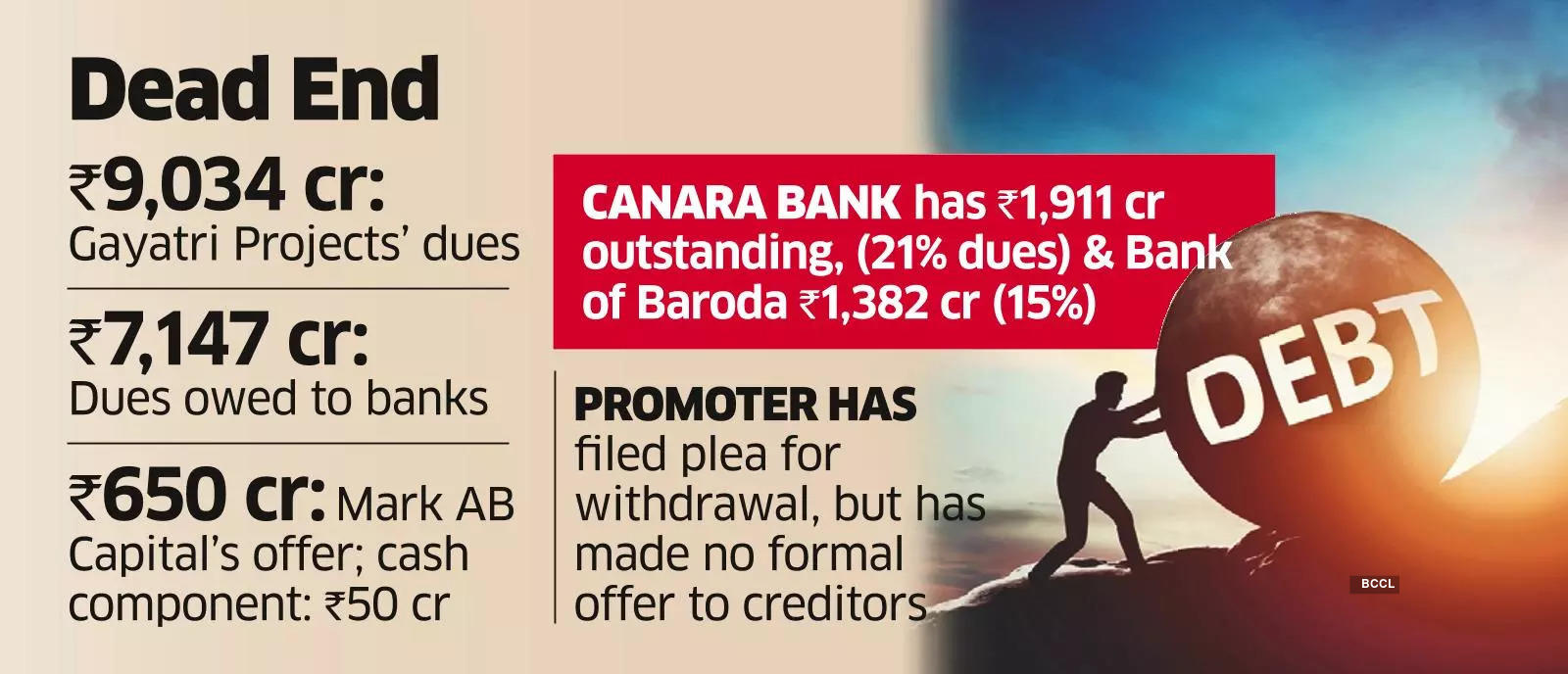

Mark AB was offering a total of ₹650 crore, of which only ₹50 crore was upfront cash, ET had reported in October. It was the only serious offer lenders had received, which has now been rejected because of its low value.

“The voting which closed late last week showed more than 66% of the lenders are in favour of liquidation. As a result, the resolution professional (RP) has already filed a plea to initiate liquidation. However, the promoters have also filed a separate petition seeking withdrawal of the insolvency process in December which is yet to be heard by the NCLT,” said a person familiar with the process. RP Sai Ramesh Kanuparthi did not reply to an email seeking comment.

The engineering, procurement and construction (EPC) company owes creditors a total of ₹9,034 crore, out of which ₹7,147 crore is owed to banks according to the latest update claims on the company’s website. Canara Bank is the largest creditor with 21% of total dues amounting to ₹1,911 crore, followed by Bank of Baroda (₹1,382 crore) or 15% of total dues.

“As things stand currently, the promoter’s offer for withdrawal under 12A of the Insolvency and Bankruptcy Code is the only option to liquidation. But for it to materialise, at least 90% of the secured creditors have to vote in its favour. So far there is no formal offer from the promoter on the table,” said a second person aware of the process.

GPL was admitted to the Hyderabad NCLT in November 2022. Besides direct loans the company had also issued guarantees to distressed projects being executed by the company like Indore Dewas Tollways and its subsidiary Sai Maatarini Tollways which also form part of dues to banks, though lower in the financial waterfall. Both these projects have been terminated by the NHAI with arbitration claims pending.

Banks also have equal charges on 16 properties owned by the promoters and group companies across Andhra Pradesh and Telangana. Nine members of the Reddy family have also given personal guarantees to lenders, according to the company website. All these claims will have to be considered by lenders before deciding on the promoter’s plan.

GPL has already undergone a failed restructuring of loans, first initiated in 2015. Some banks have also sold pledged shares of the company in the open market. The company’s shares have been suspended from trading due to the ongoing insolvency process.