MUMBAI: India’s debt markets appear to have come of age, with companies that defaulted on repayment deadlines still able to face potential investors and raise funds, promising a turnaround in their fortunes. Recently, a real estate company with a D rating (indicating default) raised ₹95 crore from the private placement bond market – sending early signs of the evolution of the junk bond market in India.

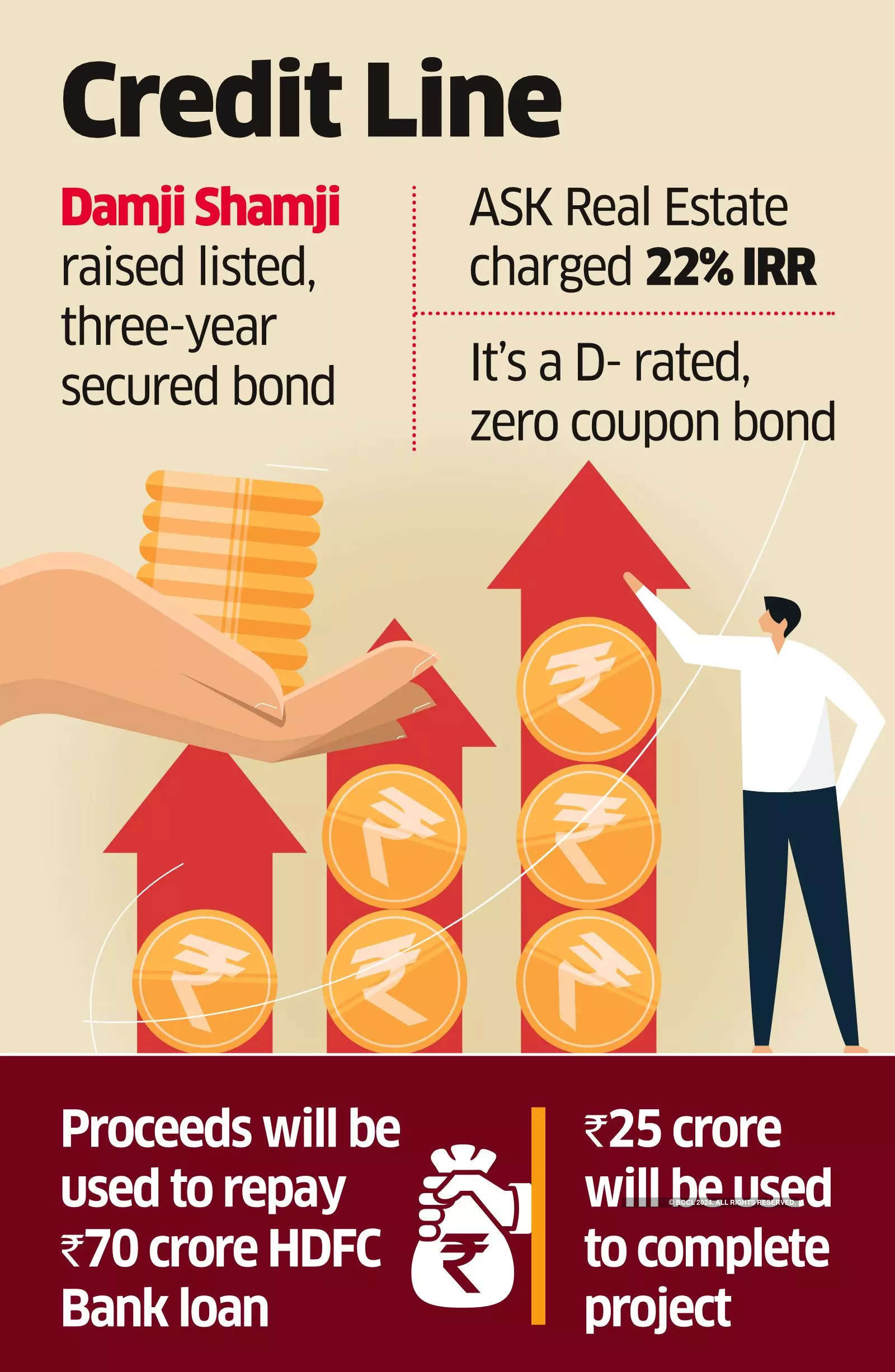

Mumbai-based Damji Shamji Realty raised ₹95 crore from the bond market in mid-December despite being assigned a D rating by India Ratings and Research, according to a stock exchange disclosure. ASK Real Estate Special Opportunities Fund IV was the sole investor, a senior company official confirmed.

Damji Shamji Realty defaulted on HDFC Bank‘s loan in April 2022, prompting the rating company to assign a D rating, the people said.

The real estate-focused special situation fund charged a 22% internal rate of return for the three-year debt facility. The proceeds from the borrowing will be used to repay ₹70 crore HDFC Bank’s loan and ₹25 crore is the working capital for completing the existing project in hand.

“Our investment from the newly closed debt fund will support their residential project, Mahavir Kalpavruksha on Ghodbunder Road, Thane,” said Bhavin Jain, chief investment officer, ASK Property Fund. “This was the last mile funding opportunity where the existing lender was refinanced and additional working capital was provided for project completion.”

Damji Shamji did not respond to ET’s request for comments.

The fundraising is rare given that the company has issued a rated, secured and listed bond.

Due to internal policies, none of the banks, insurance companies or mutual funds invest in D-rated companies, which often struggle to find investors and thus are dependent on special situation funds.

Although there have been instances of stressed companies raising money from the bond market, most of them are unlisted and unrated, said a treasury head of a bank. “These special situation funds are not particular about the rating or listing of the company, but they ensure that cash flows are ring-fenced to prevent a default,” the treasury head said.

The rating company has said that Damji Shamji’s rating may be upgraded if there is timely servicing of three consecutive instalments.

“Such entities coming through listed non-convertible debentures are good for deepening the bond market. Here the borrower is given adequate time to repay the debt, the proceeds will be used to repay existing debt and also additional funding is provided to complete the project,” said Venkatakrishnan Srinivas, founder and managing partner of Rockfort Fincap, a debt advisory firm. “This NCD structure will enable the issuer to forecast their outstanding payments and manage their liquidity well in advance. Such issuances should be encouraged for the development of the bond market,” he added.

According to the treasury head cited above, such bond issuance would result in the creation of a market for junk bonds where there are investors for every segment of the rating scale.