The insolvency watchdog has tweaked regulations to allow the hiring of an interim representative for a group of creditors like homebuyers until the bankruptcy court approves the final appointment to expedite the rescue of stressed real estate companies.

“This interim representative will have the same rights and duties as an authorised representative in meetings of the committee of creditors,” the Insolvency and Bankruptcy Board of India (IBBI) said in a statement on Thursday.

Homebuyers are usually the dominant financial creditors in residential housing projects and their authorised representatives on the committee of creditors (CoC) – which decides on the rescue plan for an insolvent company – need clearance from National Company Law Tribunal (NCLT).

This approval takes weeks and sometimes even months to come through, which holds up the resolution process.

The appointment of interim representatives will help avoid such delays.

The amendment to the Insolvency Resolution Process for Corporate Persons Regulations takes effect from September 24, IBBI said.

The amendment aims to “bolster the rights of classes of financial creditors and ensure that they have uninterrupted representation in the CoC,” said Anoop Rawat, partner at Shardul Amarchand Mangaldas & Co. It will also ensure that the functioning of the committee “is not affected by any delays on the part of the adjudicating authority,” he said.

Several real estate developers, including Jaypee, Unitech, Amrapali, Today Homes, Supertech, Logix and Ajnara, are facing insolvency proceedings.

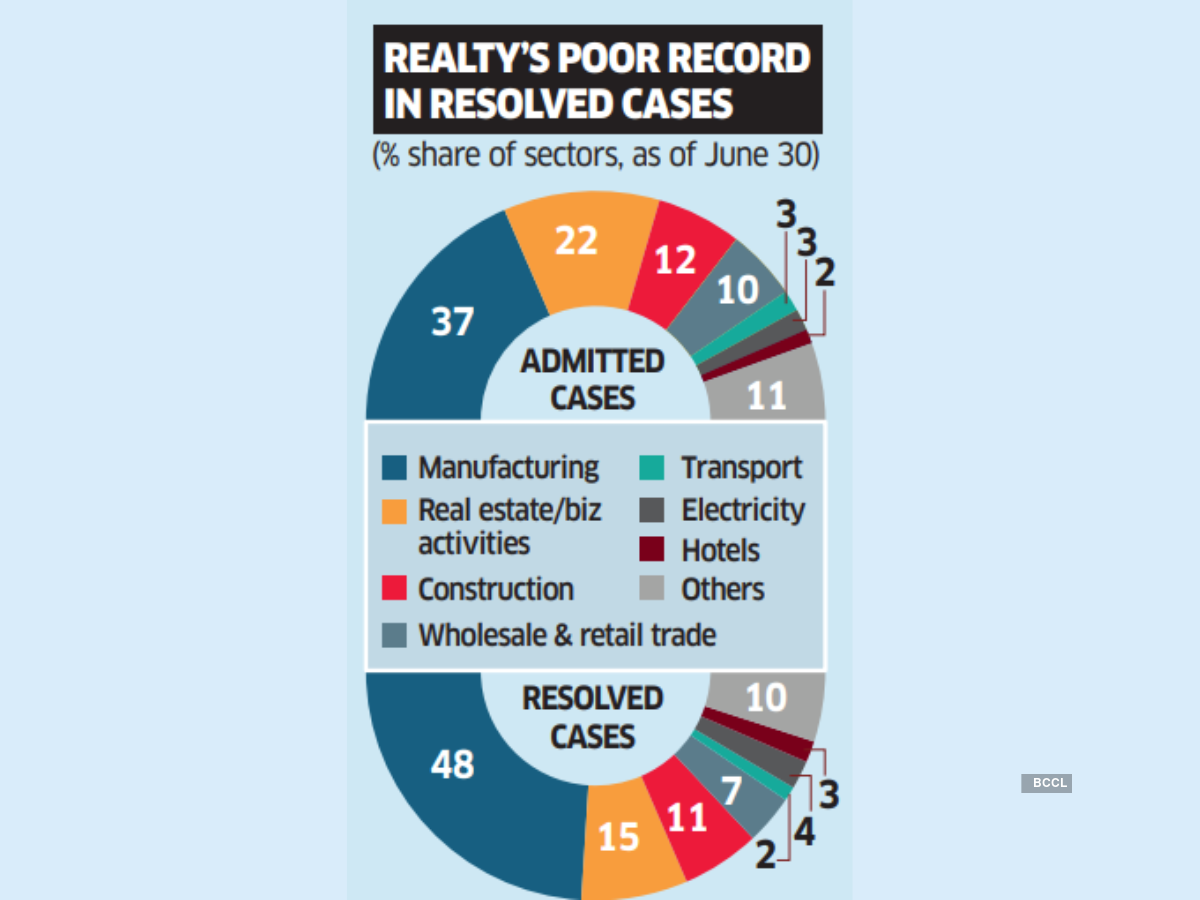

Real estate and business activities accounted for 21% of the admitted insolvency cases but only 15% of the resolved ones, as of June 2024, according to the latest IBBI data.

Experts have said given the involvement of large numbers of homebuyers, the rescue of insolvent real estate firms has turned out to be both complex and lengthy in India.