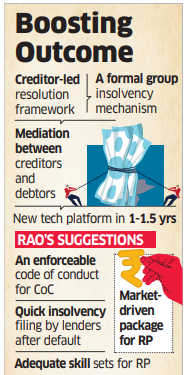

NEW DELHI: Insolvency and Bankruptcy Board of India (IBBI) chairman Ravi Mital on Saturday said a creditor-led resolution framework under the bankruptcy law is in the offing. The move aims to lower the workload of the adjudicating authority by enabling the committee of creditors (CoC) to take on greater responsibility and expedite the rescue of stressed firms, he said.

“We would be happy if less work goes before the NCLT (National Company Law Tribunal),” Mital said, conceding that the adjudicating authority is now over-burdened. He also rooted for a formal group insolvency framework.

Mital was speaking at an international conclave, organised by IBBI and INSOL India.

ET reported on September 18 that a creditor-led insolvency resolution mechanism, largely involving out-of-court arrangements, is in the works to ease NCLT’s burden and quicken recoveries for lenders.

A voluntary group insolvency mechanism is being finalised, ET reported in October, which could empower the CoC of various bankrupt companies of a group to decide if they need to join hands or pursue resolution processes separately. The CoC typically comprises financial creditors. A formal group insolvency framework was necessitated after the interconnected nature of group companies delayed resolution in a few cases, such as Videocon, Era Infrastructure, Lanco, Educomp, Amtek, Adel, Jaypee and Aircel.

Prompt Action Sought from Creditors

Addressing stakeholders at the event, Reserve Bank of India (RBI) deputy governor M Rajeshwar Rao called for an “enforceable code of conduct” for the committees of creditors under IBBI, arguing that their performance in insolvency resolutions has been “lacking in several aspects.”

In August, IBBI issued guidelines for the committee of creditors, stipulating how it needs to conduct itself, but these were essentially self-regulatory in nature.

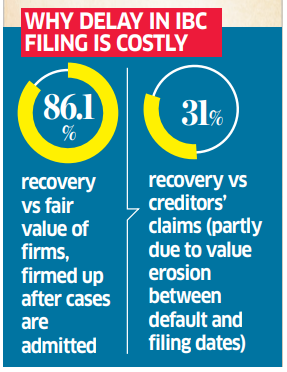

Rao also called on financial creditors to take “prompt action” to prevent further erosion of the stressed firms’ value, highlighting that the time taken by them to initiate the corporate insolvency resolution process is often several months from the date of default. “A significant amount of value is lost during this period, which ultimately impacts the recovery outcome,” he said.

The deputy governor also rooted for a market-driven compensation mechanism for resolution professionals, instead of a regulated one, given that managing a firm under the insolvency proceedings requires specialised skills. However, these professionals should also possess the required skill sets, as their expertise materially impacts the outcome of the resolution process, he added.

“If an overall assessment of the IBC is made, it shows a significant level of traction as a recovery and resolution mechanism,” Rao said.