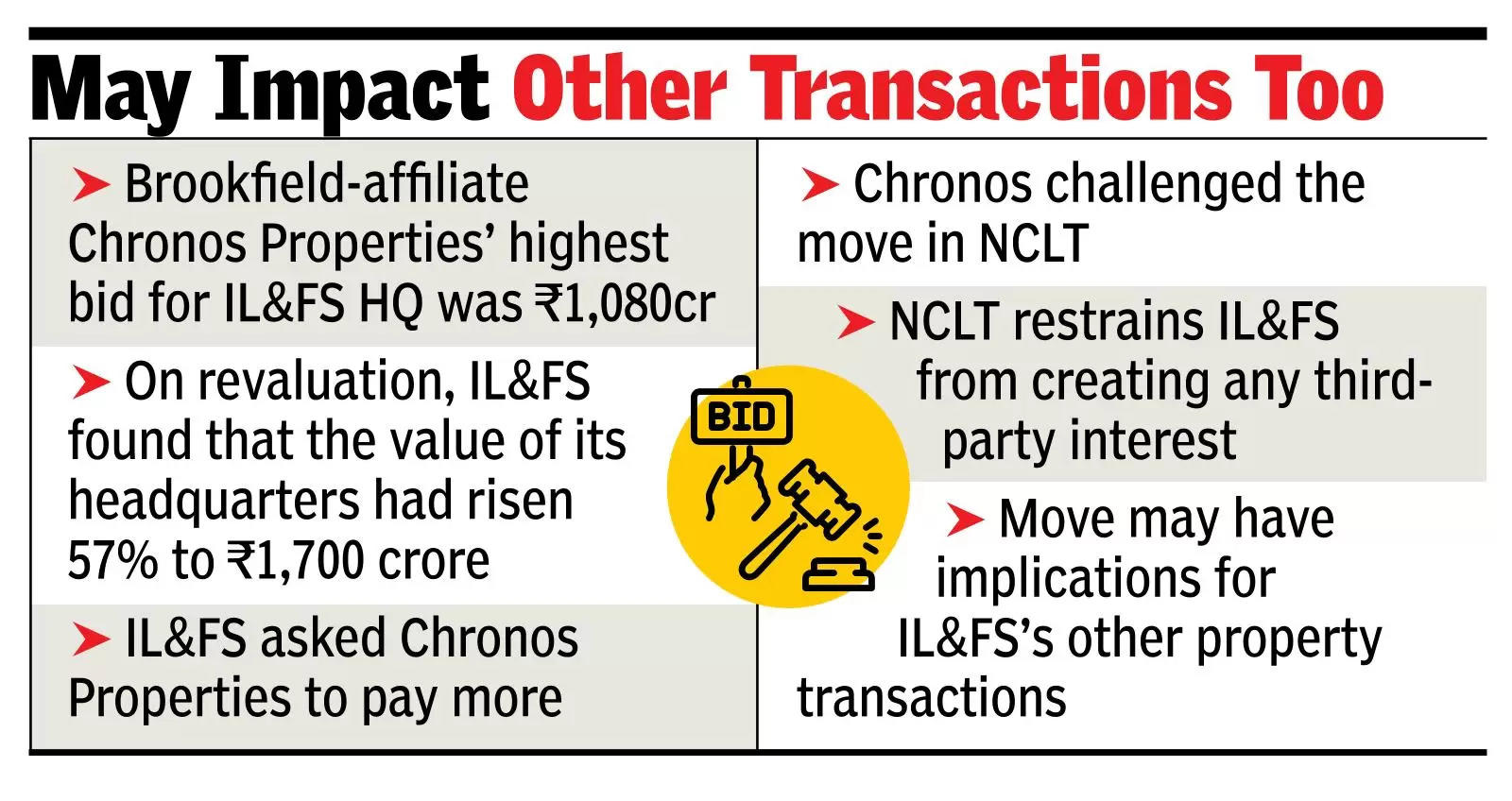

NEW DELHI: The sale of The IL&FS Financial Centre (TIFC) in Mumbai’s Bandra-Kurla Complex has hit a hurdle after IL&FS undertook a fresh valuation which estimated that the value of its headquarters had gone up 57% to Rs 1700 crore, compared to the highest bid of Rs 1,080 crore in 2021, and asked Brookfield-affiliate Chronos Properties to pay more for the property.

Chronos, which was the winning bidder, has challenged the move in National Company Law Tribunal, which has restrained IL&FS from creating any third-party interest in TIFC or insisting that the revised valuation be accepted or rejected by the buyer.

“The new IL&FS board decided to initiate fresh valuation of its HQ (TIFC), after considerable time had elapsed since it received the highest bid to sell TIFC in 2021. The revised average fair market valuation received now for TIFC is around Rs 1,700 crore. This revaluation is in line with the approved resolution objectives, that include value maximisation, being pursued by the public interest board.

The bidder has the right to accept the revised consideration proposed by IL&FS basis the new valuation or exit the transaction. The matter is pending before NCLT and due to come up for hearing later this month. IL&FS, on its part, has filed an application to implead Union of India as a necessary party in this case,” IL&FS spokesman Sharad Goel told TOI.

The move can also have implications for other property transactions of IL&FS, which are in the pipeline as real estate prices have shot up in recent years, especially in areas such as BKC where metro connectivity is boosting valuations.

Govt, which superseded the board after a massive financial scam, is keen that the value is maximised.