MUMBAI: Abu Dhabi Investment Authority (ADIA)-backed institutional investor Lake Shore has raised over ₹1,200 crore from HSBC Commercial Banking through a sustainability-linked loan for its retail property Viviana Mall in Thane, said persons with direct knowledge of the development.

This is the first such fundraising linked to sustainability efforts undertaken for any retail property in the country and among the maiden real estate financing loans availed by any institutional investor in India.

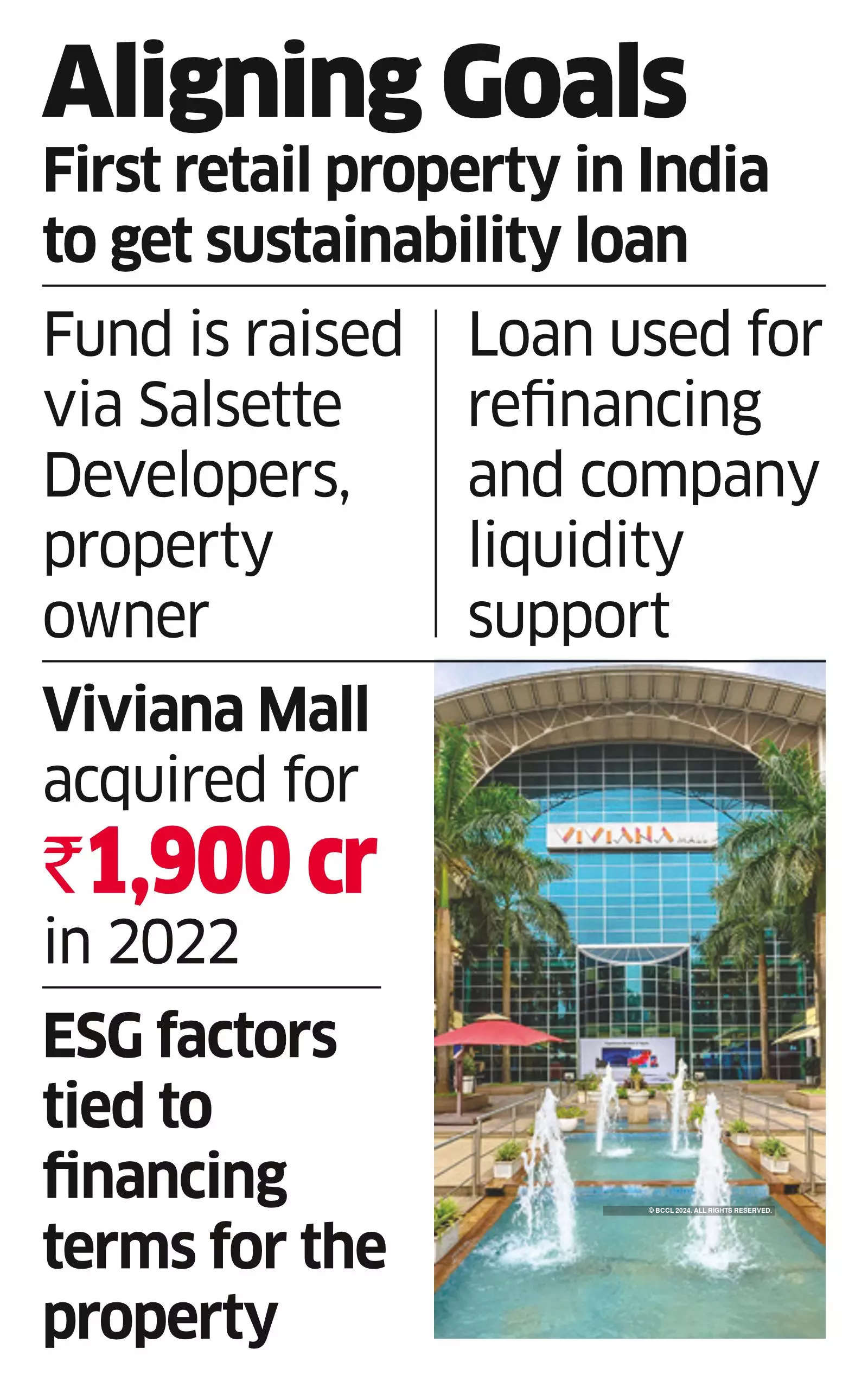

The integrated institutional investor has raised the funds through Lake Shore Group entity Salsette Developers that owns the retail property in Thane. HSBC Commercial Banking has provided the loan that was used to refinance the existing lenders and provide liquidity to the company.

In 2022, in the largest ever transaction for any single retail asset in India, it had acquired this nearly 2-million-square-feet operational property from Singapore’s sovereign wealth fund GIC and realty developer Ashwin Sheth Group for over ₹1,900 crore.

Located in Thane, one of the fastest growing residential micro-markets in India, Viviana Mall is spread across three levels and is developed on a land parcel spread over 11.7 acres. It is occupied by over 240 key domestic and global retailers including Zara, H&M, Cinepolis, Lifestyle, Reliance Retail, M&S and Shoppers Stop.

“The financing terms are directly tied to Lake Shore’s performance on crucial environmental, social and governance (ESG) factors specific to the sector. This includes key areas like sourcing green energy and improving waste recycling efforts,” said one of the persons mentioned above.

ET’s email queries to Lake Shore and HSBC Commercial Banking remained unanswered until the time of going to press.

Sustainability-linked loans are gaining traction in India as companies increasingly align their financial strategies with ESG goals. Unlike traditional green loans, which are tied to specific eco-friendly projects, sustainability loans link the cost of capital to a company’s overall sustainability performance.

If certain ESG targets, including reducing carbon emissions, improving energy efficiency, or advancing social welfare initiatives, are met, borrowers may benefit from more favourable loan terms, such as reduced interest rates.