The Telangana High Court has made a significant ruling by dismissing a legal challenge brought forth by a real estate developer regarding the imposition of the Goods & Services Tax (GST) on the transfer of development rights within joint development agreements. The ruling is poised to reverberate across all major property markets nationwide including marking a pivotal shift in the cost dynamics of redevelopment projects.

The projects involving redevelopment play a crucial role in the functionality of most property markets, especially given the backdrop of escalating land prices and the dwindling availability of vacant land parcels in key urban centres.

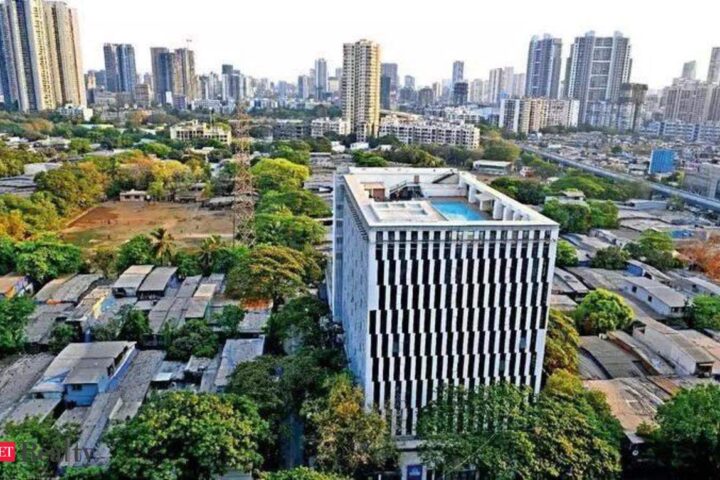

With this ruling, the landscape of property development is set to undergo a transformation, impacting stakeholders and reshaping strategies within the real estate sector. The 18% GST levy on the value of development right will make various projects across key markets including Mumbai, Pune, Bengaluru, Hyderabad, and Kolkata unfeasible for all stakeholders including landowners.

“This is a big industry issue which was bound to be settled only before the Supreme Court. As several writ petitions on this issue are pending before several courts, the industry will have to wait for some more time to obtain tax certainty on this issue”, said Abhishek A Rastogi, founder of Rastogi Chambers, who represented the petitioner. He also stated the possibility of this decision being challenged in the Supreme Court.

The South India-based developer had filed a writ petition in 2020 following a GST notification in 2019 which provided for a point of taxation to impose tax on the transfer of development right by the landowner to the realty developer. With this, the petition had stated that the authority had effectively intended to impose tax on a transaction akin to sale of the land.

According to Rastogi, the moot point before the high court was whether GST is applicable in case of a joint development agreement when there is transfer of development right from the landowners to the developer. The interesting point revolves whether the point of taxation to determine the timing of payment of tax can come by way of a notification when the taxability of the transaction per se is disputed.

“It must be noted that the sale of land is specifically excluded from the purview of GST as stamp duties are levied on these transactions. It was argued before the court that the transfer of development right is akin to sale of land and hence such a transfer must not be subject to GST,” Rastogi added.

In June, real estate developers had approached the Ministry of Finance with their concerns over the impact of the GST being levied on rehabilitation apartments being built and given back, free of cost, to existing occupants as part of redevelopment projects.

The Confederation of Real Estate Developers’ Association of India (CREDAI) – MCHI, had written to Finance Minister Nirmala Sitharaman to request a change in GST structure to ensure viability of redevelopment projects in Mumbai Metropolitan Region (MMR).

Real estate projects involving redevelopment and rehabilitation are the mainstay of Mumbai’s property market as the land-starved city has few vacant land parcels. At present, around 19,000 properties in the city are awaiting redevelopment.