India’s thriving housing market faces the key challenge of a widening demand-supply gap due to a large number of stalled or unsold projects and a shortage of distressed funds, say industry leaders. They believe the government needs to create a comprehensive turnaround platform to fully unlock India’s real estate potential and ensure the sector’s growth.

Currently, only a few dedicated funds such as Nisus, Piramal Distressed Asset Fund, Kotak Special Situations Fund, SWAMIH (Special Window for Affordable and Mid-Income Housing) Fund, and 360 One Assets are actively involved or venturing into funding such projects.

“Rescuing a stalled project requires significant time, effort, and resources, yet the returns may not stack up proportionately to the inherent potential liability of such projects,” said Amit Goenka, MD and CEO of Nisus Finance. “Without strong regulatory incentives, clear profitability, and ring fencing, the risk and liabilities, many developers shy away from taking on these projects despite the market potential and haircut by lenders,” he said.

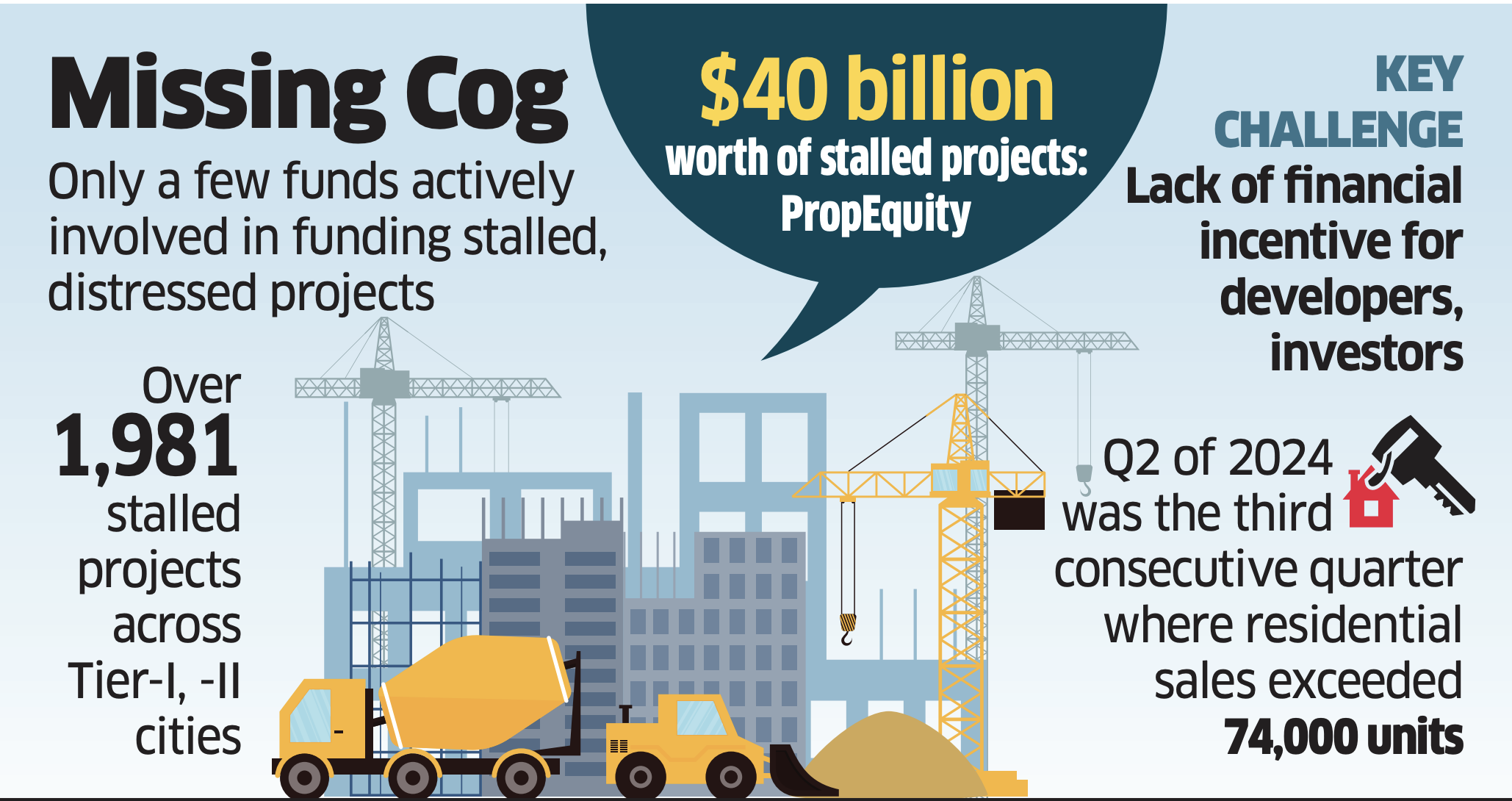

Currently, there are more than 1,981 stalled projects across Tier I and II cities. These projects comprise more than 500,800 unsold or incomplete units, according to PropEquity, a data analytics and research firm. Industry experts estimate the total value of these homes at $40 billion at ₹1 crore per unit-almost equivalent to the combined market capitalisation of India’s top 15 realty firms.

Of the total, 1,636 stalled projects comprising 431,946 units are in 14 Tier-I cities, while 345 projects totalling 76,256 units are in 28 Tier-II cities.

“The sheer size of this backlog underscores a systemic issue. Stalled projects often arise due to financial mismanagement, regulatory hurdles, or delayed approvals. Many of these developments, comprising 300-350 units each on average, have been left in limbo for years, leaving both developers and homebuyers in a state of uncertainty,” said Sankey Prasad, CMD, Colliers India.

The gravity of the situation underscores the inadequacy of current interventions. While the SWAMIH Fund has been a game changer for the affordable and mid-income housing segments, delivering over 32,000 units so far, its strict eligibility criteria exclude many projects.

The fund mainly focuses on near-completion projects registered under the Real Estate (Regulation and Development) Act (RERA), leaving a major share of stalled premium and luxury projects outside its scope.