BENGALURU: Real estate developer Prestige Estates Projects plans to use the Rs 5,000 crore it raised through qualified institutional placement (QIP) to primarily reduce debt and acquire assets to expand its portfolios nationwide.

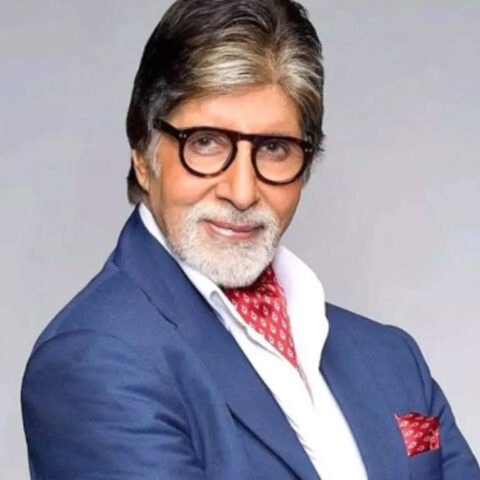

“We plan to allocate approximately Rs 1,500 crore towards debt reduction (and) Rs 1,750 crore for land acquisition,” Irfan Razack, chairman and managing director of Prestige Group, told ET in an interview.

“The remaining funds will be directed towards equity contribution towards capex projects and general corporate purposes,” he said.

The firm plans to invest Rs 16,000 crore to fuel its growth and sell Rs 50,000-crore worth residential assets over the next five years. It also targets more than four times growth in exit rental income from office and retail segments by FY28, the company said in an investor presentation post the March quarter results.

Earlier this month, Prestige raised Rs 5,000 crore through a private placement of equity shares to institutional investors.

In July, the company had obtained approval from its shareholders to raise capital through public or private offerings, including a QIP.

Its board of directors also cleared another plan to monetise the hospitality business and established a subcommittee to supervise the process.

Prestige plans to have at least 50 million square feet of projects under pipeline annually over the next three to five years across major cities such as Mumbai, Bangalore, Pune, Chennai, Delhi-NCR and Hyderabad. In the last six quarters, the company acquired land worth Rs 6,000 crore across Delhi-NCR, Mumbai, Hyderabad and Bengaluru.

“Our top line sales for FY24 reached Rs 21,000 crore, and we have projected a 15-20% growth on it for the current fiscal. We are highly confident in achieving this target,” Razack said.

According to industry insiders, the company is working on an initial public offering (IPO) for the hospitality business. For the office and hospitality business, a REIT listing is being considered to unlock potential value to further expand the hospitality and rental business, they said.

“It is all a work in progress and depends on board and internal committee approvals,” said Razack, who refused to share details on it.

The firm’s exit rental income from retail and office stood at Rs 933 crore in FY24. It targets Rs 3,933 crore from this segment by FY28.

Additionally, Prestige aims to reduce its gross debt by Rs 900 crore and ease the cash flow strain related to its hospitality segment’s capital expenditure plan. The company plans to double its hospitality portfolio over the next three to four years, investing a total of Rs 1,700 crore. Currently, it holds 1,489 keys under hospitality assets across various brands including Hilton and Marriott across the country.

The firm had earlier said the hotel segment has the potential to generate Rs 2,000 crore in revenue, which is over 2X growth on its current revenue of Rs 982 crore.

Prestige Estates has partnered with Marriott to introduce new brands in India, with a total inventory of 801 keys in Goa and Karnataka, requiring an investment of around Rs 1,000 crore. The company is actively seeking opportunities in new markets such as Srinagar, Ayodhya, Goa and Mumbai, while also expanding its presence in existing markets.

Nationally, the group has 140 million sq ft of residential projects under development and pipeline. This is followed by 31 million sq ft of office and 7 million sq ft of retail space under development and in the pipeline.

Currently, 70% of its portfolio is residential.

The firm has a debt of Rs 8,179 crore with a debt-equity ratio of 0.68 as of June 2025. Its average borrowing cost stood at 10.76%.