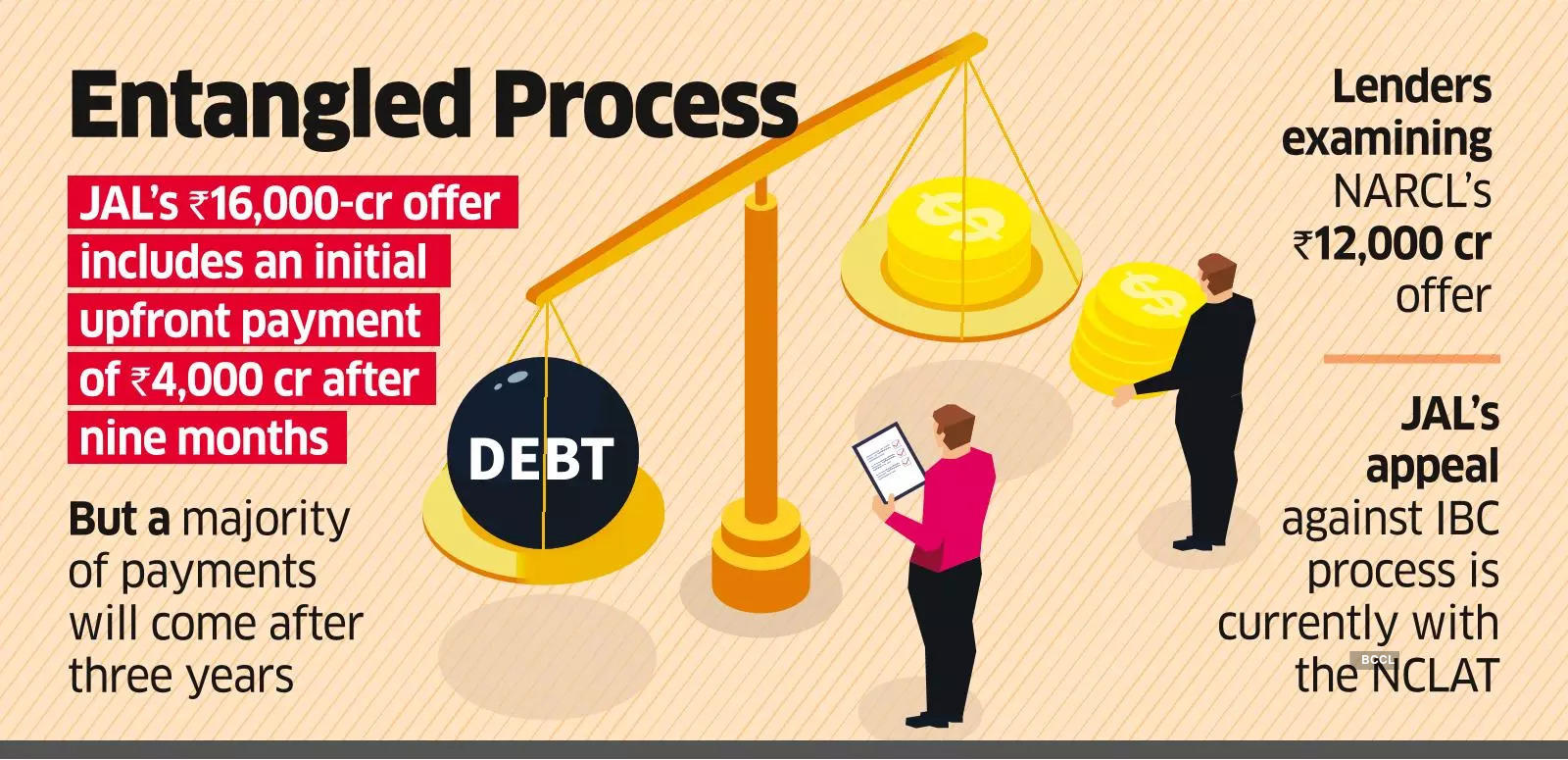

MUMBAI: Debt-laden Jaiprakash Associates (JAL) last week made a ₹16,000-crore settlement offer to lenders in a desperate attempt to avoid bankruptcy.

JAL said an initial upfront payment – of about ₹4,000 crore – will not be made immediately, but only after nine months from the date lenders agree to the settlement, people aware of the details said. JAL will be raising the ₹4,000 crore it needs to pay lenders by bringing in investors and selling some assets, said the people cited above.

A majority of the payments – of the remaining ₹12,000 crore – will come only after three years, two people aware of the details said, pointing to the downside in the offer.

Banks, meanwhile, are still evaluating the government-backed National Asset Reconstruction Co’s (NARCL) ₹12,000-crore offer. The company’s appeal against its admission into insolvency is currently with the National Company Law Appellate Tribunal (NCLAT).

“The company made a presentation to creditors last week, offering ₹16,000 crore to withdraw insolvency proceedings. It includes a lot of assumptions and a long payment timeline, which is not very attractive and that has been conveyed to them by the banks,” said a person aware of the negotiations.

The company did not reply to an email seeking comment.

With ₹57,190 crore of admitted claims, JAL is the biggest unresolved insolvency case pending before the National Company Law Tribunal (NCLT). In terms of size, the JAL debt is only dwarfed by the ₹65,000 crore owed by Videocon Industries.

But unlike other stuck advances, JAL has assets on the ground, making bankers hopeful of a respectable recovery. These assets include operating cement plants with a capacity of over 9 million tonnes; real estate around the Yamuna Expressway Industrial Development Area; hotels in Delhi, Noida, Mussoorie and Agra; EPC business, power plants, a hospital in Noida and the Buddh International Circuit. Interim resolution professional Bhuvan Madan has admitted claims of 31 creditors.

“There are chances of a recovery and buyers will come because there are assets on the ground. Considering a settlement from the promoters without any cash on the table is not possible.

JAL has been told that assumptions and assurances in a presentation do not pass muster. Banks now have the NARCL offer too and the bankruptcy case is also ongoing so there is little chance of this offer making any headway,” said a second person aware of the negotiations.

State Bank of India is the largest creditor with close to ₹15,500 crore of admitted claims followed by ICICI Bank which has claims of close to ₹10,500 crore. ICICI Bank is designated as the lead lender in the case. ICICI did not reply to an email seeking comment.

NARCL made a fresh ₹12,000 crore bid to take over JAL, increasing its earlier ₹10,000 crore offer made in March, ET reported in its November 14 edition. That offer, a mix of 15% cash and 85% security receipts, is still being considered by banks.

Creditors also view any settlement attempt by JAL with suspicion given the delay in the initiation of bankruptcy process against the company.