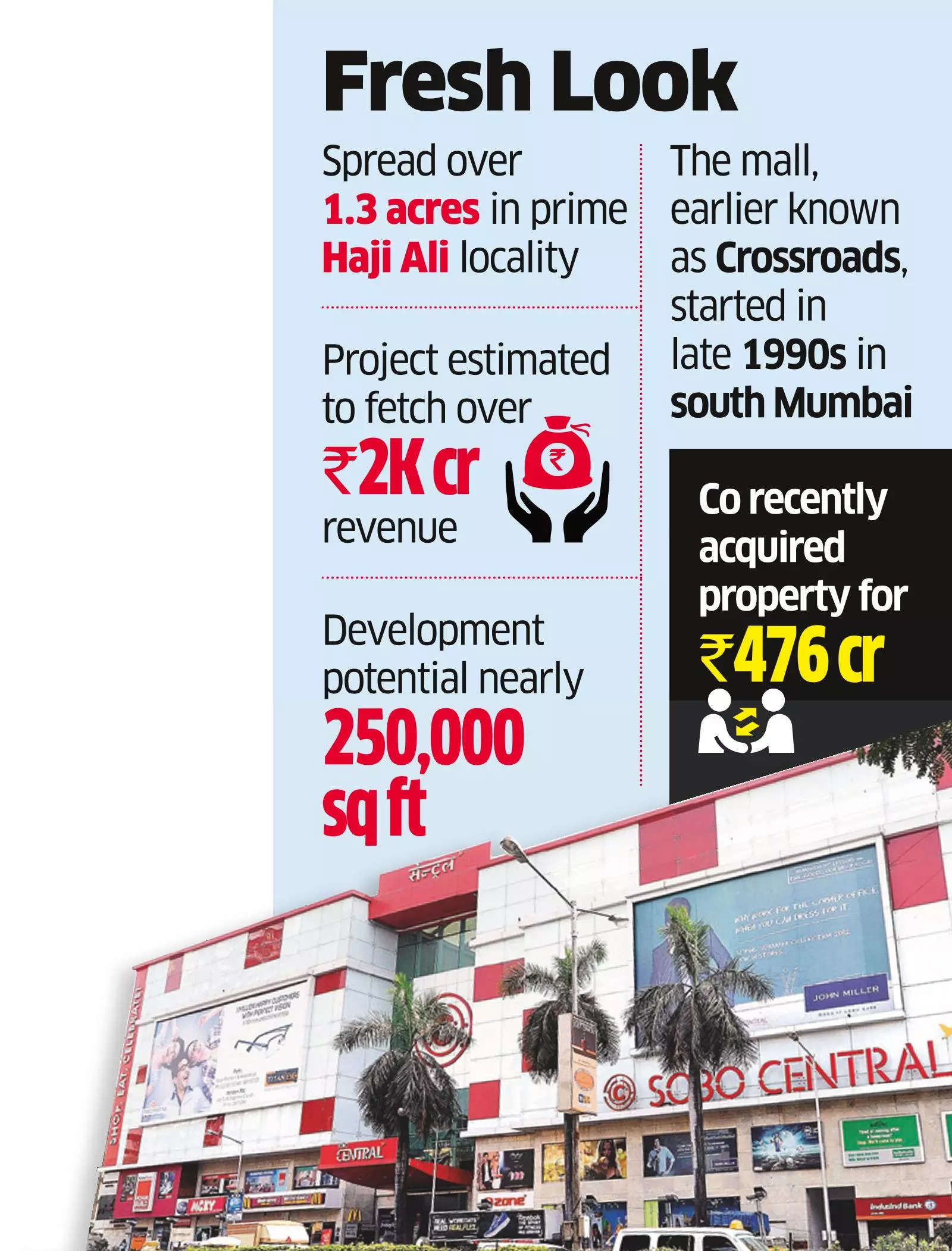

Realty developer K Raheja Corp is planning to redevelop SOBO Central Mall, the country’s first mall, into a high-end luxury residential project, said persons with direct knowledge of the development.

The mall, earlier known as Crossroads, started in the late 1990s in south Mumbai.

Spread over 1.3 acres in prime Haji Ali locality, the mall is expected to make way for an around 50-storey sea-view superstructure with nearly 250,000 sq ft development potential. Based on the current property prices in the vicinity, the project is estimated to fetch over Rs 2,000 crore revenue.

“The developer has started chalking out plans for the proposed redevelopment and is expected to finalise the entire plan soon,” said one of the persons mentioned above.

The developer recently acquired the property for Rs 476 crore from its erstwhile owner Kishore Biyani’s Bansi Mall Management Company. The property was put on the block by the creditors led by Canara Bank to recover their dues and the creditors had already received a bid worth Rs 475 crore for the same.

However, Biyani made an offer to settle the dues at Rs 476 crore and the same was accepted by the lenders. K Raheja Corp has acquired Biyani’s stake in the mall with 150,000 sq ft leasable space and the latter has utilised the money to settle Bansi Mall Management Company’s creditors.

According to property consultants, this is one of the bigger plots available in the vicinity of Carmichael Road, Pedder Road and Altamount Road, known as India’s Billionaires’ Row. Most other plots in the vicinity are relatively smaller and are housing society redevelopment projects.

ET’s email query to K Raheja Corp remained unanswered until the time of going to press.

Recently, K Raheja Corp entered into an agreement to jointly develop a 2.5-acre land parcel in Mumbai’s Worli into a luxury residential project with revenue potential of more than Rs 2,000 crore.

The developer’s residential platform and the landlord have finalised a revenue share structure for the proposed joint development, wherein K Raheja Corp will get 57% revenue share, while the balance 43% will go to the landlord.

Over the past two years, the Indian luxury housing market has witnessed a remarkable surge in demand and sales activity across the nation’s top eight cities. The country’s financial capital, Mumbai, emerged as the leader in this segment, with most such transactions recorded in upscale south Mumbai and Worli-Prabhadevi area.

Realty developers have been capitalising on this growing appetite for luxury properties, by introducing innovative designs, world-class amenities and bespoke services to cater to the evolving tastes of affluent homebuyers.