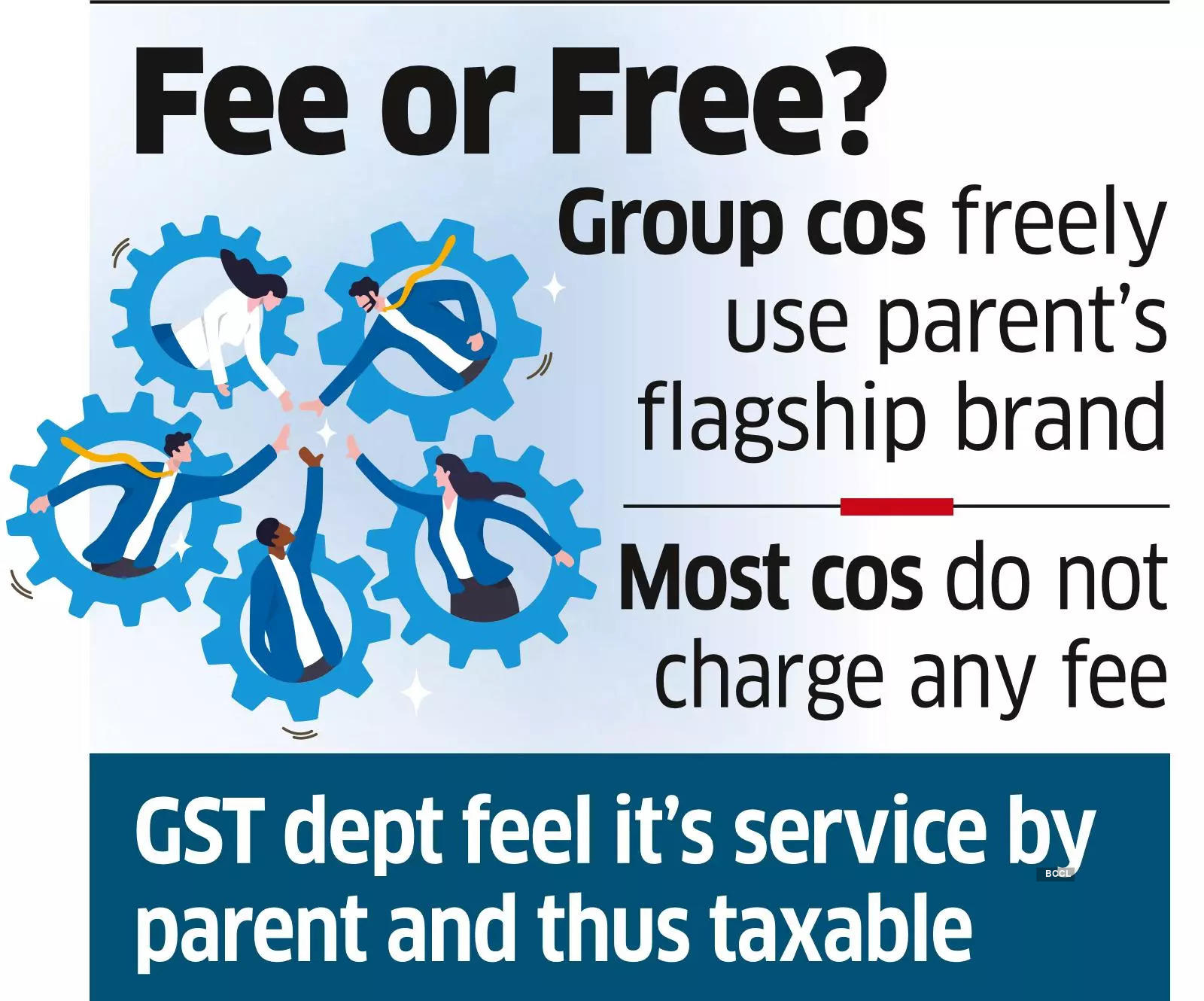

In a move that could open a Pandora’s box and spark an outcry from Corporate India, Mahindra & Mahindra has been served a notice from the office of the goods and services tax (GST) for the use of the ‘Mahindra’ brand name by various group companies.

The show cause notice has questioned why M&M should not pay GST for the service given by the parent to the group companies by letting them use the flagship brand and logo. The notice relates to 2017-23. A Mahindra spokesperson declined to comment to ET on the communication from the indirect tax department.

Different interpretations

Tax officials believe GST should be imposed on the royalty or fee that group entities are supposed to pay to the parent company, even as corporate circles and senior tax practitioners think it’s an absurd demand. “How do you ascribe a value to a brand and determine the fee which subsidiaries and associates in different businesses would have to pay?” said a tax professional.

However, if the GST department sticks to its stand, multiple business houses would be exposed to such notices and subsequent tax claims.

GST is paid by consumers and remitted to the government by the businesses selling the goods or services. For instance, if the royalty amount is fixed at Rs 10 crore, the applicable GST on it, at 18%, would be Rs 1.8 crore. So, the parent company would receive Rs 11.8 crore from the group company and pay Rs 1.8 crore to the government.

It’s unclear at this stage whether the department is testing the waters as GST, administered under a comparatively recent statute, lends itself to different interpretations. Under the GST law, tax applies in ‘related party transactions’ even if no consideration is paid. A few months ago, multiple builders in Mumbai were sent notices for lending their brand and trade names to subsidiaries, joint ventures and special purpose vehicles (SPVs) carrying out the projects.

In real estate and infrastructure development, each project is typically organised under a separate entity or SPV. Such vehicles, controlled by the main company, carry out construction, fundraising and property sale under the parent’s umbrella brand.

Compared to the real estate business, where different SPVs carry out the same activity, member companies of a diversified group are engaged in different businesses.

Unlike ‘corporate guarantees,’ there are no specified rules for brand fee. On guarantees – often extended by the parent to help group companies obtain higher credit rating and raise money at a cheaper rate – the tax is levied at the rate of 18% on 1% of the total guarantee amount. So, if the size of a corporate guarantee is Rs 100 crore, the parent company will have to shell out Rs 18 lakh as GST.