MUMBAI: The government-backed bad loan aggregator National Asset Reconstruction Co (NARCL) has increased its offer to take over the debt of Jaiprakash Associates (JAL) even as the company’s appeal against its admission into insolvency is pending before the National Company Law Appellate Tribunal (NCLAT).

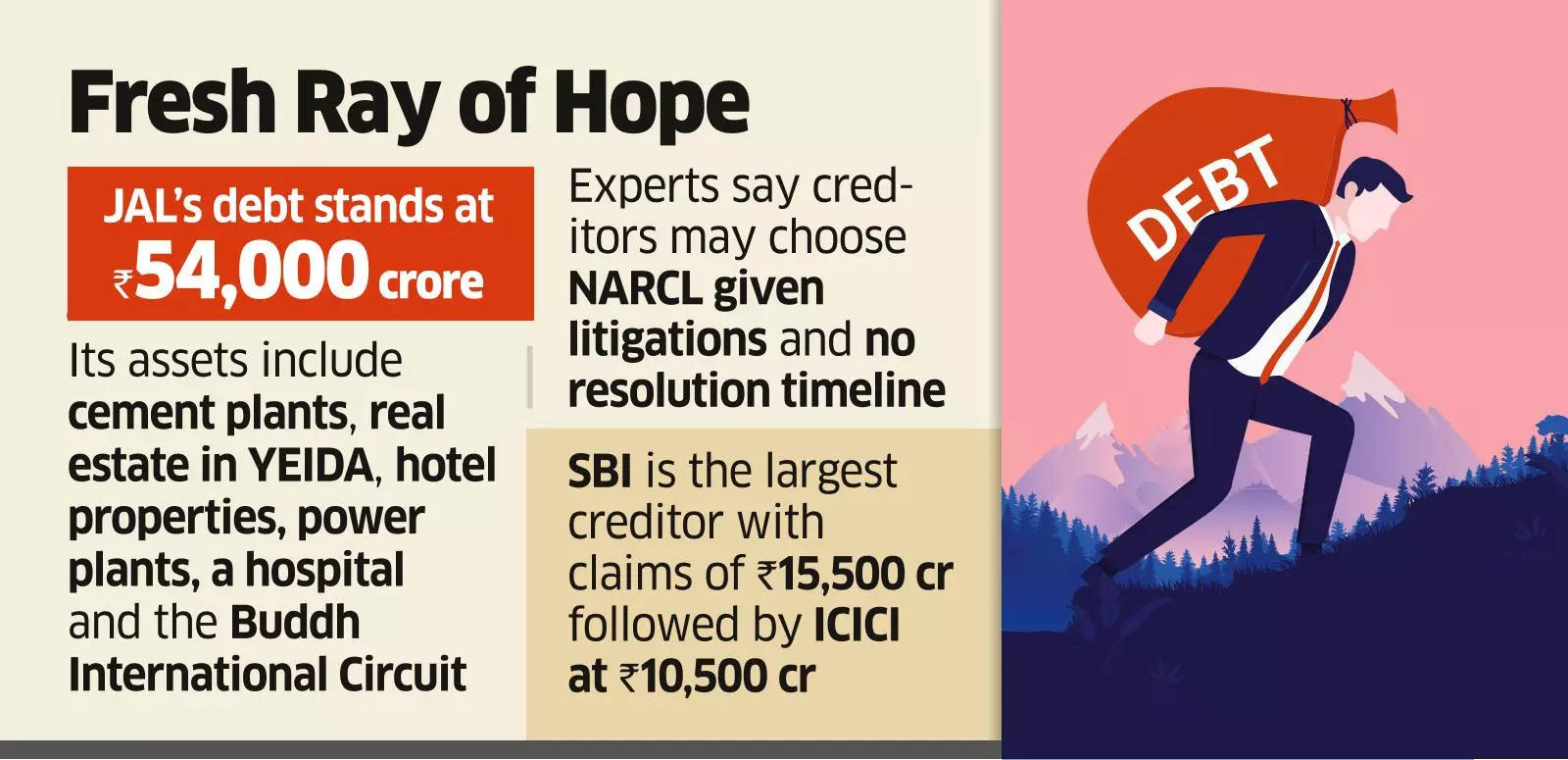

Last month, NARCL made a fresh ₹12,000 crore bid to take over the ₹54,000 crore debt, increasing its earlier ₹10,000 core offer in March. The fresh offer follows a valuation exercise carried out by the bad loan aggregator after it had given its first offer, two people with direct knowledge of the matter said.

The NARCL offer includes an upfront of 15% or ₹1,800 crore in cash and the remaining 85% of the loan value in security receipts valid for five years guaranteed by the government, a feature unique to NARCL.

“NARCL’s revised offer came just before Diwali after they had completed their own valuation exercise. There is now a fair amount of clarity since a majority of the claims and names of creditors are known. Banks are yet to meet to discuss the new offer,” said one of the persons cited above.

JAL is the biggest insolvency resolution case since the Insolvency and Bankruptcy Code (IBC) came into force in 2016 which is yet to be resolved. In terms of debt size, the JAL resolution is only dwarfed by the ₹65,000 crore owed by Videocon Industries to its creditors.

NARCL did not reply to an email seeking comment.

JAL’s assets include operating cement plants with a capacity of over 9 million tonnes; real estate around the Yamuna Expressway Industrial Development Area (YEIDA); hotels in Delhi, Noida, Mussoorie and Agra; EPC business, power plants, a hospital in Noida and also the Buddha International Circuit.

Interim resolution professional Bhuvan Madan has admitted claims of 31 creditors according to an update earlier this month.

State Bank of India (SBI) is the largest creditor with close to ₹15,500 crore of admitted claims, followed by ICICI Bank which has claims of close to ₹10,500 crore. ICICI Bank is designated as the lead lender in the case. ICICI did not reply to an email seeking comment.

Separately, both ICICI and SBI are in the process of conducting their own valuations of the company which will be used as a benchmark in their negotiations with NARCL, the first person cited above said.

“JAL has assets on the ground which can be monetised. However, the long delay in this case, persistent litigation by promoters and no real timeline for a bankruptcy process may push creditors to consider a sale to NARCL. The biggest advantage of such a move is that it consolidates the debt with one creditor, reducing the need for multiple creditors to agree to a resolution, which will ultimately quicken the process,” said a second person aware of the negotiations.

The NARCL offer comes at a time when NCLAT last week reserved its order in response to the company’s appeal against the NCLT decision to start insolvency proceedings against JAL in June this year. That NCLT order itself came after a six-year delay as ICICI had filed an insolvency plea against JAL back in 2018.

JAL was among 26 defaulters that the Reserve Bank of India (RBI) had directed to be taken to the bankruptcy process in 2017. Judicial delays have spooked lenders in the case despite the potential for recovery, but the NARCL offer may provide creditors an escape route.