MUMBAI: Your property tax expenditure will remain the same this year. BMC has informed the state that it intends to issue property tax bills for the year 2024-25 without any revision in rate.

Every year, property tax is collected by BMC from the over 9 lakh properties over which the municipal corporation has jurisdiction.

BMC has the authority to increase property tax rates every five years. The last revision was effected in 2015-16. The proposed increase for 2020-21 had been rejected due to the pandemic, and another proposed increase in 2022 was also rejected. If a property tax hike is proposed next year, it will come after a decade without an increase. With no elected corporators in place, BMC must seek state govt approval for any property tax hike.

A BMC official said, “Currently, we are charging property tax based on the Stamp Duty Ready Reckoner rates, which form the base value of the property. There has not been any revision in rate since 2015-16.”

The civic body is also of the opinion that if the hike is proposed this year and then again next year as per the five-year revision schedule, it is likely to put a burden on citizens for two consecutive years.

For the civic body, property tax is the biggest source of revenue currently. Till the year 2017, octroi was the highest source of revenue but it was abolished and replaced with Goods and Services Tax.

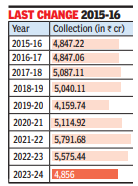

BMC, which had set a target of Rs 4,500 crore from property tax for the financial year 2023-24, had collected Rs 4,856 crore. Previously, in the BMC budget 2023-24, the municipal commissioner had announced Rs 6,000 crore as its collection target, which was revised to Rs 4,500 crore later.