Canada’s continuing inflow of immigrants, combined with an existing and growing housing shortage, has made the need for additional multifamily housing development more acute than ever.

But despite some progress in speeding up creation of new units, significant challenges remain in catching up with demand.

There will be no quick fixes, either, according to a panel of senior industry experts at the recent Real Estate Forum at the Metro Toronto Convention Centre.

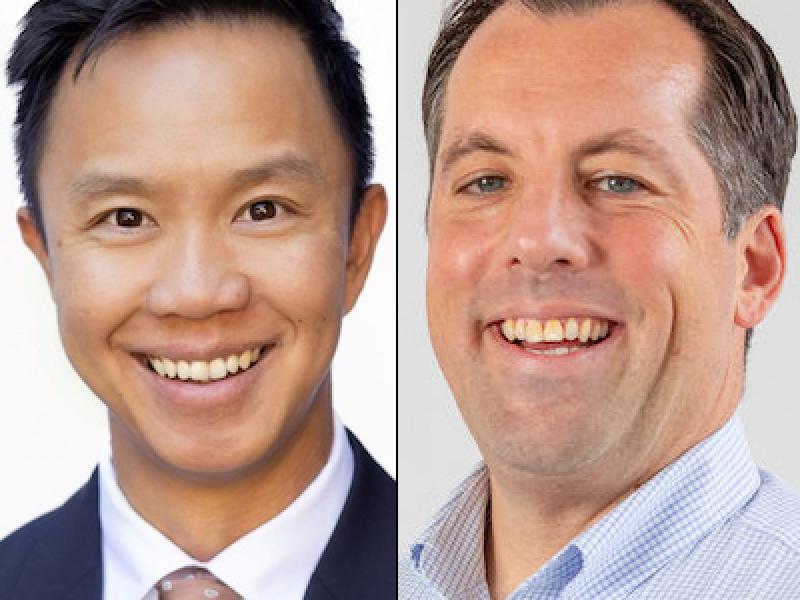

Aik Aliferis, the senior managing director of investments of the Canadian multifamily and commercial group for Institutional Property Advisors (IPA), moderated the discussion, touching on a wide range of issues pertaining to the multifamily sector.

Fitzrovia Real Estate

Fitzrovia Real Estate CEO Adrian Rocca said his company has 23 apartment towers representing 8,500 apartments at various stages of development in the Greater Toronto Area.

Despite the attention paid in some quarters to office-to-residential conversions, however, Fitzrovia has no such projects.

Apartment suite mixes are neighbourhood-dependent and Fitzrovia also has specific size targets for units, Rocca said:

- over 400 square feet for a studio;

- at least 570 square feet for a one-bedroom;

- 820 to 850 square feet for a two-bedroom; and

- between 1,000 and 1,100 square feet for a three-bedroom.

Rocca said office buildings generally have large floor plates, which will over-size apartment suites, and that’s one factor keeping Fitzrovia away from office-to-residential conversions.

“There are a couple of trades that represent a good chunk of total development costs that are stubbornly holding up pricing,” said Rocca.

“We’d like to see those reflect the current market environment where new starts are down 70 to 75 per cent year-over-year.”

Rocca said there are 30,000 rental units across Canada which landlords and developers want to convert to condominiums, which he doesn’t think should be allowed.

Rocca would also like to see municipal property tax abatement to encourage rental housing construction.

Rocca said the City of Toronto has become more open to collaborating with developers on zoning and site plan applications, but more efficiency is needed as delays outside of developers’ control cost them money.

Fitzrovia has access to different buckets of capital. Rocca said it has considered 87 potential land acquisition deals in Toronto over the past eight months but will probably only act on one or two.

The current quiet transaction market could liven up over the next 12 months, however.

“People are looking for liquidity, whether it’s a combination of shoring up their balance sheet or diversifying their exposure,” said Rocca.

“There could be a really great buying window, but we’re cautiously looking at it and we’re definitely not pulling the trigger on as many deals.”

GWL Realty Advisors

Toronto’s GWL Realty Advisors (GWLRA) has 262 industrial, office, residential, retail and other properties encompassing approximately 45 million square feet and valued at about $18 billion under management.

One-quarter of the portfolio is residential – about 10,000 units across Canada.

“We’re keen on urban centres because these are areas that are rich in amenities, culture or employment opportunities and are well-serviced by transit,” said senior vice-president of residential Erica Penrose.

Penrose said the Toronto Central Metropolitan Area has a shortage of 50,000 purpose-built rental units, a number projected to grow to 350,000 by 2030. GWLRA recently delivered 2,000 units and another 2,000 should follow in the near term.

There’s continuing investor appetite for purpose-built apartments, according to Penrose, but there aren’t many greenfield development sites on which to build. GWLRA does own well-situated assets in different classes, creating intensification opportunities, she said.

Penrose cited a 60-year-old, 14-storey office building at 200 University Ave. in downtown Toronto; GWLRA plans to build a 51-storey residential tower atop the existing structure.

Greyspring Apartments

Toronto-based Greyspring Apartments was formed in 2018 by Greybrook Realty Partners and Marlin Spring, which recently changed its name to Baz Group of Companies. It’s a value-add player that owns approximately 3,000 residential units, primarily in Montreal.

Director of acquisitions Sarah Ward said Greyspring wants to scale up and perhaps make a few dispositions in Montreal. It is also considering new markets.

“We’re underwriting constantly but being very selective in terms of what we’re actually willing to pull the trigger on,” Ward said.

Greyspring is “quite comfortable” having higher vacancy rates than other apartment owners because it’s repositioning several older assets, including units and entire building systems.

People are staying in the rental market longer now, Ward observed, due to high mortgage rates and house and condominium prices.

Boardwalk REIT

“Seventy per cent of our communities aren’t governed by price controls so, in the environment that we have here today, we believe we’re certainly set up for some of the best performance,” said Boardwalk REIT president James Ha, who noted non-regulated markets have much higher tenant turnovers and Boardwalk can have units rented again within 24 hours.

Ha pointed out rent-to-income ratios are 24 per cent in Calgary and 28 per cent in Edmonton, where there are no rent controls, making them the most affordable major cities in which to rent across Canada.

Calgary-based Boardwalk provides more than 33,000 residential suites in over 200 Canadian communities, mainly Alberta and Saskatchewan. It also owns properties in British Columbia, Ontario and Quebec.

Ha said Alberta is adding 200,000 residents annually from immigration and inter-provincial migration and 80,000 new housing units are needed to house these people.

There are only 35,000 under construction, however, so Boardwalk is taking an “every little bit helps” approach and converting storage and office spaces in its buildings to housing units where possible.

There are densification opportunities in the portfolio and Ha estimates 1,000 units could be added without tearing anything down.

Boardwalk hasn’t purchased properties in the past couple of quarters but Ha said it’s working on opportunities similar to those of 2022, partnering with developers bringing new projects into a different real estate and economic environment from when they were underwritten several years ago.

Boardwalk isn’t involved with converting older office buildings into rental housing because the costs are too high. However, Ha believes more cities should follow Calgary’s lead providing subsidies and fast approvals for such conversions to make them more financially viable.

QuadReal Property Group

QuadReal executive vice-president of residential Anthony Lanni applauded the federal government’s elimination of sales tax from purpose-built apartment construction costs and the Rental Construction Financing Initiative, which provides low-interest loans to encourage the construction of rental housing for middle-income Canadians.

Such initiatives will spur more and faster construction and give companies like his the opportunity to bid on and engage in multifamily investments, according to Lanni.

Vancouver-headquartered QuadReal Property Group manages $73.8 billion in assets across Canada, the U.S., Europe and the Asia Pacific region.

Affordability challenges are paramount for both existing and prospective tenants and QuadReal’s long-term goal is to add more rental housing supply.

In the shorter term, it’s aiming to make older units and buildings more efficient so tenants spend less on utilities, while also adding value in other ways to make them feel more comfortable.

Lanni agreed there are few economic incentives to convert older office buildings to residential due to the initial expense, higher operating costs and often a lack of scale.