MUMBAI: Manish Lalwani-promoted Omkara ARC has acquired Park Hyatt Hyderabad‘s loans for ₹300 crore from lenders at a 34% discount from sellers that included BlackRock and JM Financial.

The all-cash deal involved Omkara paying ₹300 crore to buy the ₹450 crore principal outstanding of Park Hyatt in Hyderabad, a 5-star luxury hotel consisting of more than 200 rooms including 25 suites and 40 serviced apartments in Hyderabad. The total debt outstanding including interest and principal is ₹700 crore.

“Omkara has bought hotel debt from JM Financial and BlackRock at 66% of the debt,” said a source. “The transaction involved acquiring the NCDs from lenders.” Spokespersons of both Omkara ARC and JM Financial did not respond to requests for comment immediately while BlackRock could not be reached immediately for comment.

Originally, the NCDs (series I and II) were held by BlackRock and JM Financial. The hotel situated in Banjara Hills, Hyderabad, opened to the public on April 29, 2012.

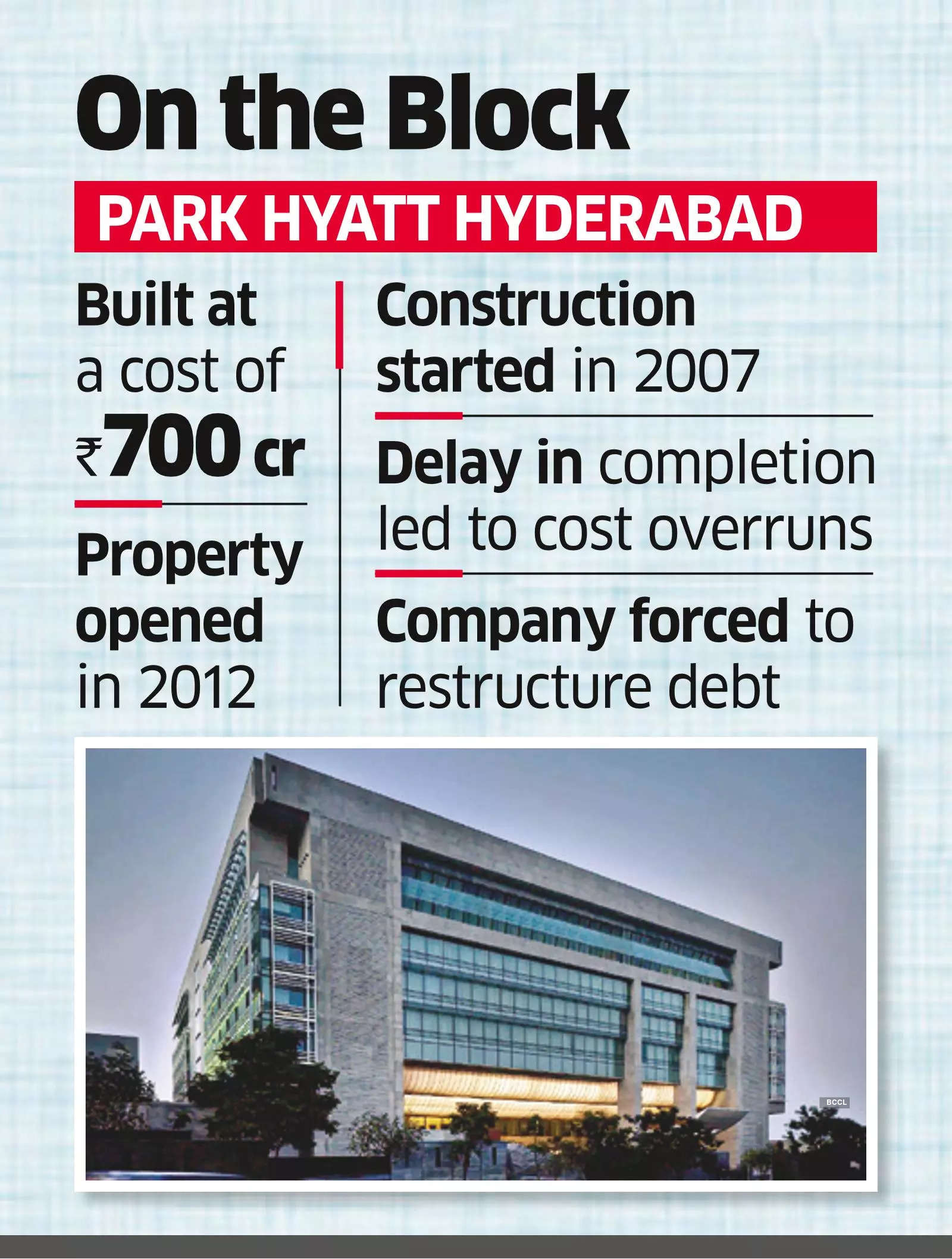

Park Hyatt Hyderabad, developed by Gayatri Group promoted by T Subbarami Reddy, Gayatri Hi Tech Hotels and operated by global chain Hyatt Hotels under a 25-year management contract, was built at a cost of around ₹700 crore.

The construction of the hotel started in 2007 and the property was opened in 2012. However, the delay in completion of the project led to cost overruns, forcing the company to restructure its debt. The hotel project was financed in the debt-equity ratio of 60:40.

Omkara ARC’s acquisition of the Park Hyatt Hyderabad follows its previous acquisitions of hotels in Bengaluru and Pune from the Piramal Group. Omkara bought properties like the JW Marriott in Bengaluru and a Crowne Plaza facility in Pune, as part of the Advantage Raheja exposure. This acquisition gave Omkara full ownership of all loans linked to this exposure.

The deal, completed at a premium, resulted in Piramal gaining over ₹700 crore. Advantage Raheja’s total loan was around ₹900 crore and Omkara ARC along with Oaktree Capital bought it for ₹700 crore. Omkara ARC had initially purchased the loans and made partial payments to Piramal in cash and security receipts.