MUMBAI: Property tax bills uploaded by the BMC on its website on Friday evening raised the hackles of citizens and public representatives and created confusion in their minds, as the BMC issued the assessment bills for 2023-24 with a hike.

A footnote in the bill cited the Court had held three rules of the Capital Valuation rules as invalid and also stated that the bills were being issued as a security/adhoc basis and that the civic body reserved the right to reassess the properties with retrospective effect and collect tax accordingly after announcement of a revised policy on assessment.

Subsequently, on Saturday, Municipal Commissioner Chahal clarified that though no hard copy of bills has been issued, terms such as ‘bill payable’ and ‘bill amount’ were used on the BMC website, in light of the Supreme Court’s recent order with respect to property taxation and consequent legal opinion obtained by the property tax department, which created the confusion.

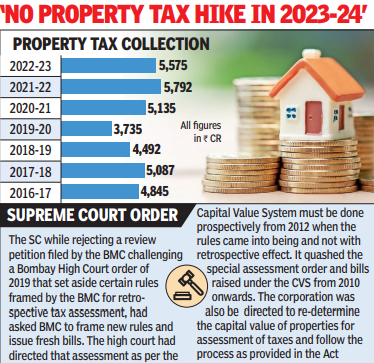

To avoid any confusion, actual property tax bills shall be raised mentioning only the payable amount, Chahal said. The Commissioner also pointed out that the payable amount this financial year shall be equal to the amount payable for the last financial year and there has been no property tax increase in the current financial year.

A senior BMC official told TOI that BMC had written to the state seeking an amendment regarding property tax in the MMC Act 1888, after seeking a legal opinion following the Supreme Court order. The amendment is expected to be tabled in the assembly.

The last revision of property tax was carried out by BMC in 2015. Subsequently, revision of Property Tax was deferred during 2020-21 and 2021-22 due to Covid-19. In 2022-23, the BMC deferred the revision by another year. Earlier this year, the Supreme Court had rejected a review petition filed by the BMC challenging a Bombay High Court order of 2019 that set aside certain rules framed by the BMC for retrospective tax assessment.

Former corporator Asif Zakaria, who paid the bill generated for the housing society, where he resided, as a test case, and received a receipt, questioned the explanation provided by the BMC administration.

“The BMC has generated bills with 15 to 20 percent hike, as compared to last year. If the BMC has generated a bill and even if the terms bill payable and bill amount are mentioned, the bill amount is a liability and payment can only be deferred. If there has been no hike in the property tax, how did the system generate the bill,” Zakaria said.