MUMBAI | BENGALURU: In a major strategic move, HDFC Bank has decided to divest several key commercial properties inherited during its 2023 merger with its mortgage-lender parent, HDFC, said persons with direct knowledge of the development. Monetisation of these assets, which include some residential apartments, could together fetch about ₹3,000 crore for India’s most-valued bank.

The assets to be sold include the HDFC House in South Mumbai’s Churchgate and residential apartments that were allotted to HDFC’s senior officials earlier.

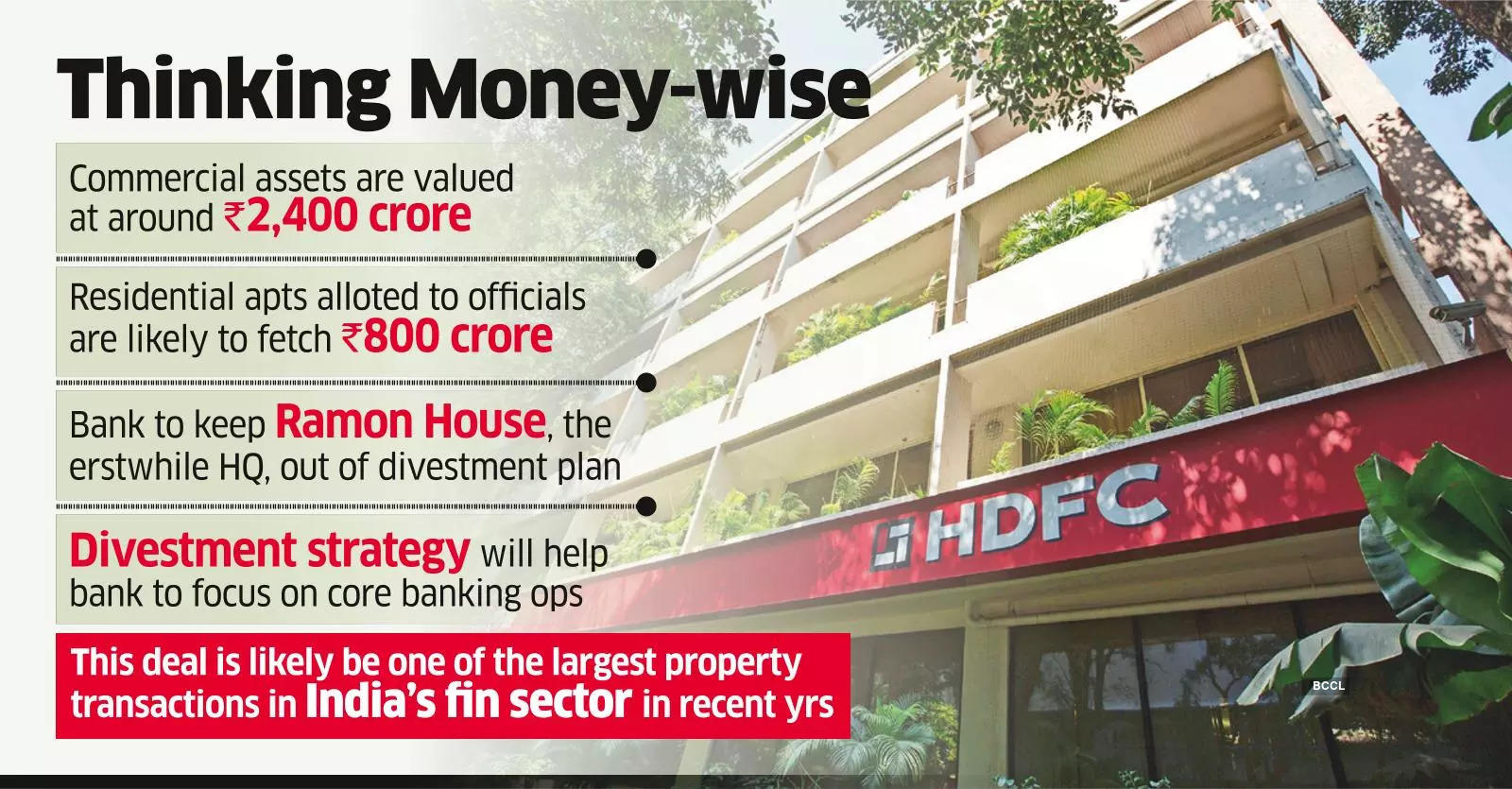

Commercial assets across south Mumbai, Kalina, Chandivali and other cities including Kolkata, Mysore, and Bengaluru are valued at around ₹2,400 crore. Residential apartments are likely to be valued around ₹800 crore.

HDFC House was acquired by the housing finance company from Hindustan Unilever in 2014 for ₹300 crore. This property, erstwhile Lever House, used to house Hindustan Unilever’s headquarters before it was shifted to the Andheri suburbs.

Prior to this buyout, HDFC used to be a tenant in this commercial building spread over 153,000 square feet. The bank has, however, decided to keep Ramon House, the erstwhile headquarters of HDFC, out of this monetisation exercise.

“This strategic move marks a significant reshaping of HDFC Bank’s asset holdings post-merger, as it pivots away from managing these physical assets to concentrate on core banking operations,” said one of the persons mentioned above.

This divestment strategy, according to him, indicates the bank’s intent to streamline its real estate assets and bolster its liquidity position post-merger. ET’s email query to HDFC Bank remained unanswered until the time of going to press.

Industry insiders estimate that the sale could attract interest from real estate investment firms, developers, and institutional investors looking to expand their footprint in these key locations.

According to property consultants, HDFC Bank’s real estate portfolio sale is expected to further solidify the trend of Indian financial institutions offloading non-core assets to optimise their balance sheets.

Additionally, the move also reflects HDFC Bank’s proactive steps in capitalising on the current demand surge in commercial property market, driven by a recovering economy and increasing interest from both domestic, international investors.